Heard Technologies

Description

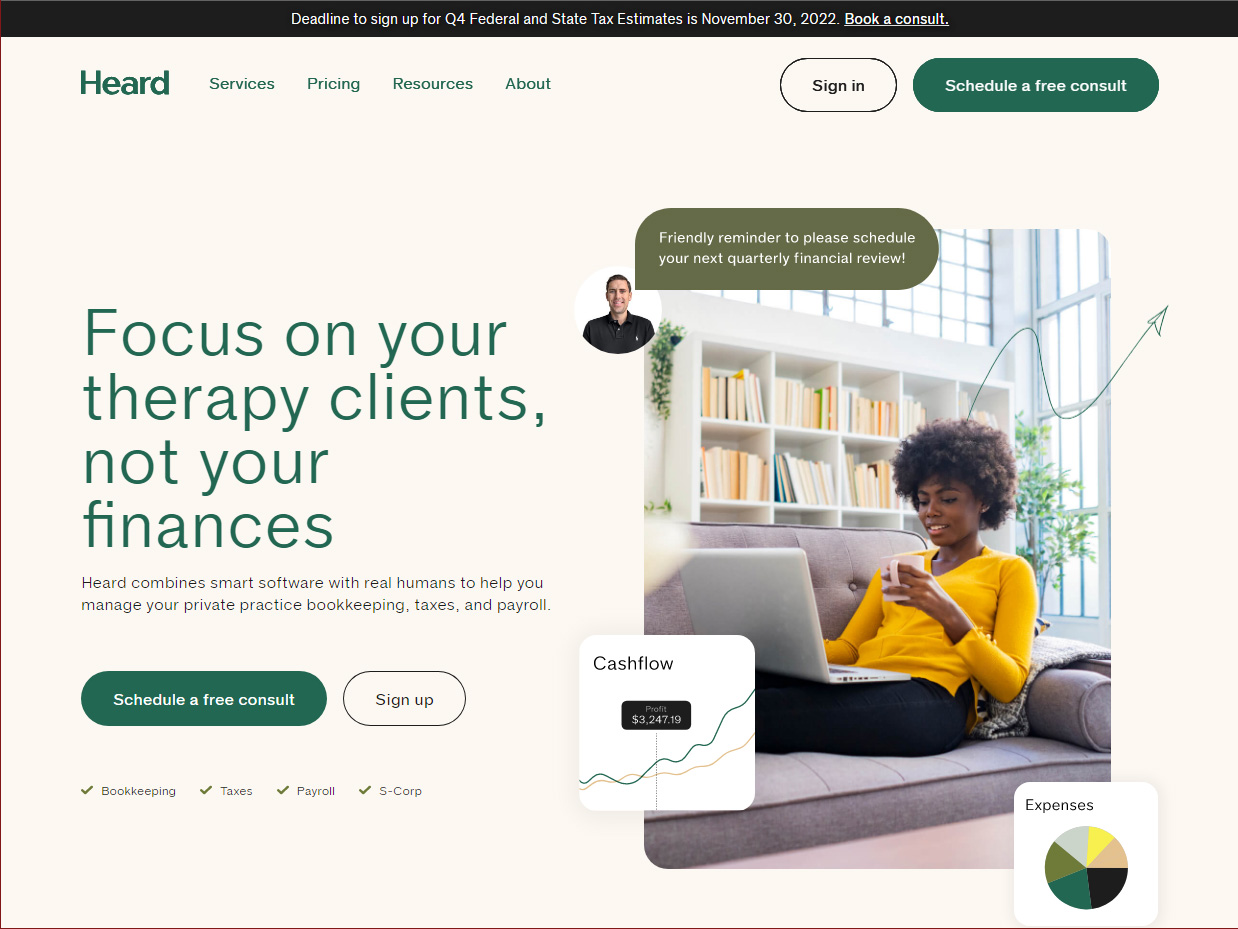

Heard is an all-in-one accounting solution for therapists. It combines software and accountants to help your business with bookkeeping, taxes, payroll, and S Corporation formation.

The company provides full-service bookkeeping for therapists and lets you focus on clients by keeping your financial records complete and accurate. With such features as automatic income and expense import, accurate accounting of every transaction, tax deduction maximization, and financial health tracking be sure to have a healthy private practice.

Complete tax preparation for therapists will let you avoid any IRS or state penalties and assure that your tax filings will be prepared on time. Heard will handle all your fillings and prepare personal & business income taxes and both federal and state returns. Also, they will prepare quarterly estimated taxes, review already paid taxes, plan on your income and expenses and estimate your IRS and state payments. You will get 24/7 online access to your tax filings and the tax preparer will get all your fillings done in time.

Heard will optimize your private practice tax savings and minimize your expenses. They will look at your finances, find out where you can save money on taxes, and implement all the recommendations themselves.

The tax saving feature includes quarterly financial check-ins and a dedicated accountant will give you suggestions, review your practice’s financial health and remind you about tax payments. Also, Heard monitors your business and helps to structure your practice right (setting up or changing to S Corporation). They will provide calculations of the most tax-efficient amount you pay yourself and maximize deductions (making sure that all tax-deductible expenses would be claimed on your tax returns).

Photo

Services

$149 Bookkeeping

Connect your bank accounts, credit cards, and practice management software Record and categorize all of your business transactions Review unknown transactions Identify tax-deductible expenses Generate financial reports

Tax

Prepare your business tax returns Prepare your personal tax return Estimate quarterly taxes due Approve tax returns Pay quarterly estimated taxes

Tax-saving strategies

Meet 1:1 via web meeting every quarter Review upcoming estimated tax payments File an S Corp election with the IRS Advise you on how much to pay yourself

Payroll

Set up Gusto payroll service so you can pay employees and contractors Log hours and set pay amounts Take care of payroll tax withholding and filings Pay for Gusto payroll service (if applicable)