The Accountancy Partnership

Description

The Accountancy Partnership was founded in 2006 and helps limited companies, startups, sole traders, and limited liability partnerships with accounting and bookkeeping. They provide accounting, tax returns, VAT returns, CIS returns, payroll, and bookkeeping services.

For companies, contractors and small businesses the AP provides full accounts produced by a dedicated accountant. Accounts are fully compliant with HMRC guidelines and complied and submitted to Companies House and HMRC.

As a part of online tax return services, your tax returns will be completed by a dedicated tax accountant. You will get regular tax efficiency reviews & recommendations and unlimited help & advice from your tax accountant. Additionally, the AP will represent you in the event of an HMRC investigation.

The Accountancy Partnership provides VAT returns services such as quarterly returns completed by a dedicated accountant, regular reviews, fully making Tax Digital compliant VAT returns and the AP will represent you in case of investigations by HMRC.

Payroll services provided by The Accountancy Partnership include help from a dedicated payroll clerk, production of all employee payroll documentation, dealing with HMRC, filing RTI returns, automated email reminders for parol periods, and more.

Additionally, the AP provides CIS returns services that include CIS Returns production by a dedicated accountant, production of necessary CIS documentation, submission to HMRC, compliance to CIS Return standard, and representation in HMRC.

Photo

Services

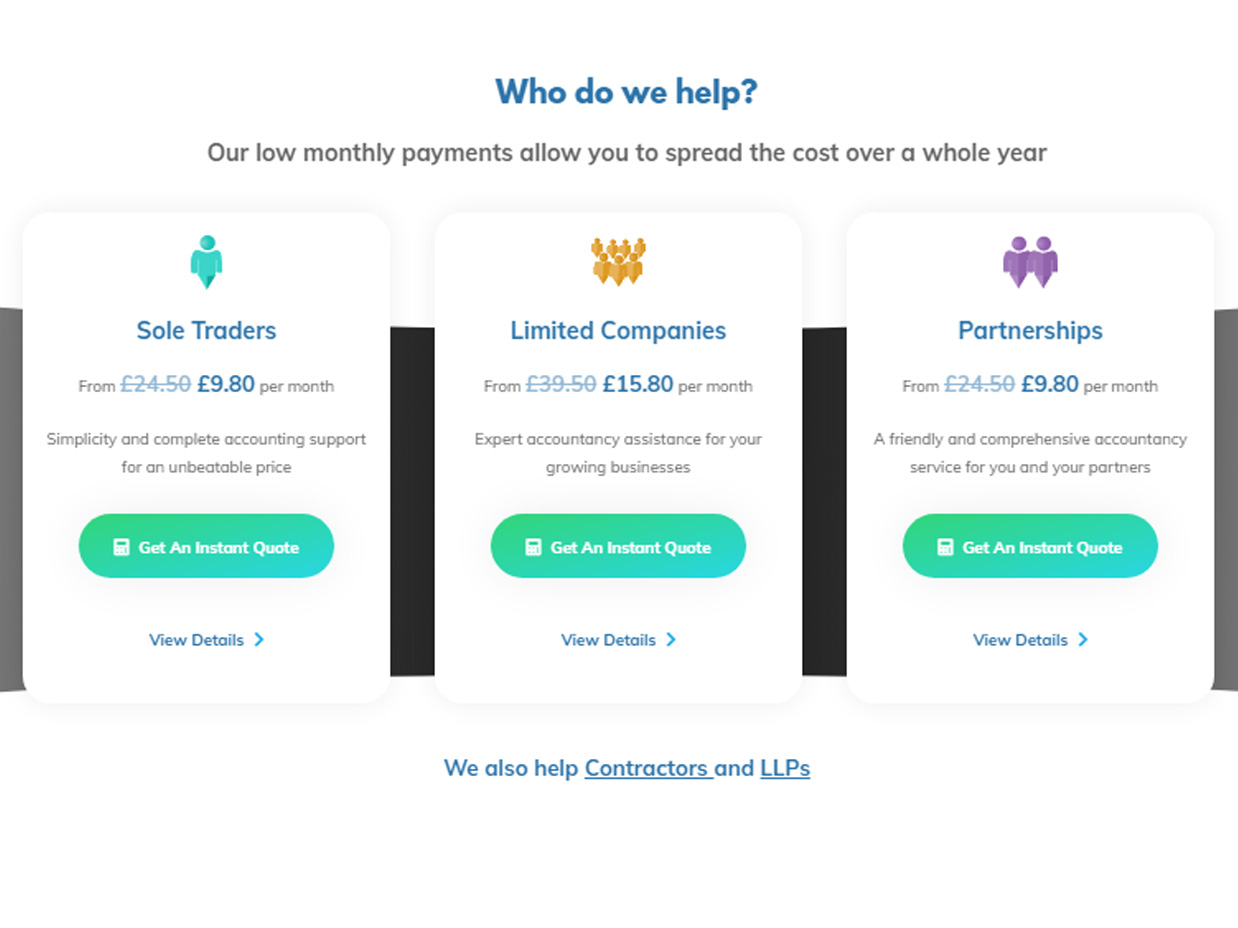

$27 Accounting Sole Traders

Simplicity and complete accounting support for an unbeatable price

$44 Accounting Limited Companies

Expert accountancy assistance for your growing business enterprise

$27 Accounting Partnerships

A friendly and comprehensive accountancy service for you and your partners

Bookkeeping

Bookkeeping is an add-on service to our accountancy packages. The quote you receive will also include the cost of your accounts and tax returns. If you require more complex bookkeeping services, such as currency conversions, we may charge an hourly rate instead. All fees will be agreed up front before any work takes place.

Tax

Our tax accountants make preparing and submitting your return as easy as possible

$27 VAT

1. We send you a reminder We'll let you know when your VAT returns are due and ask for your bookkeeping records. 2. We complete your VAT return After your returns are completed, they'll be double checked to ensure they're accurate. 3. We submit your VAT return Once we've received your approval, we'll submit your MTD compliant VAT return to HMRC. Job done!

Payroll

Payroll is an add-on service to our accountancy packages. The quote you receive will also include the cost of your accounts and tax returns. We charge a fixed fee of £8 per month for up to two directors, or £4 per payslip for employees (with a £16 per month minimum charge).

Maximilian

I have to say that the energy and adaptability of this company are actually impressive, they’re really committed to the success of your business, and that’s something you don’t experience often with other companies. Some people may think that the accountancy partnership costs more than some service providers, but they did make this well worth it for sure.

October 29, 2022

Brian B. Bob

We recently came back to The Accountancy Partnership, and I can tell you I wish we had never left the first time because compared to other companies, this one is the most comfortable to work with. If you want modern customer focused accounting, this company is the best choice for you.

November 25, 2022