Description

Osome free you from manual accounting, untangle e‑commerce, and set up companies

Get a dedicated accountant who knows your business and automated software that reconciles your payments

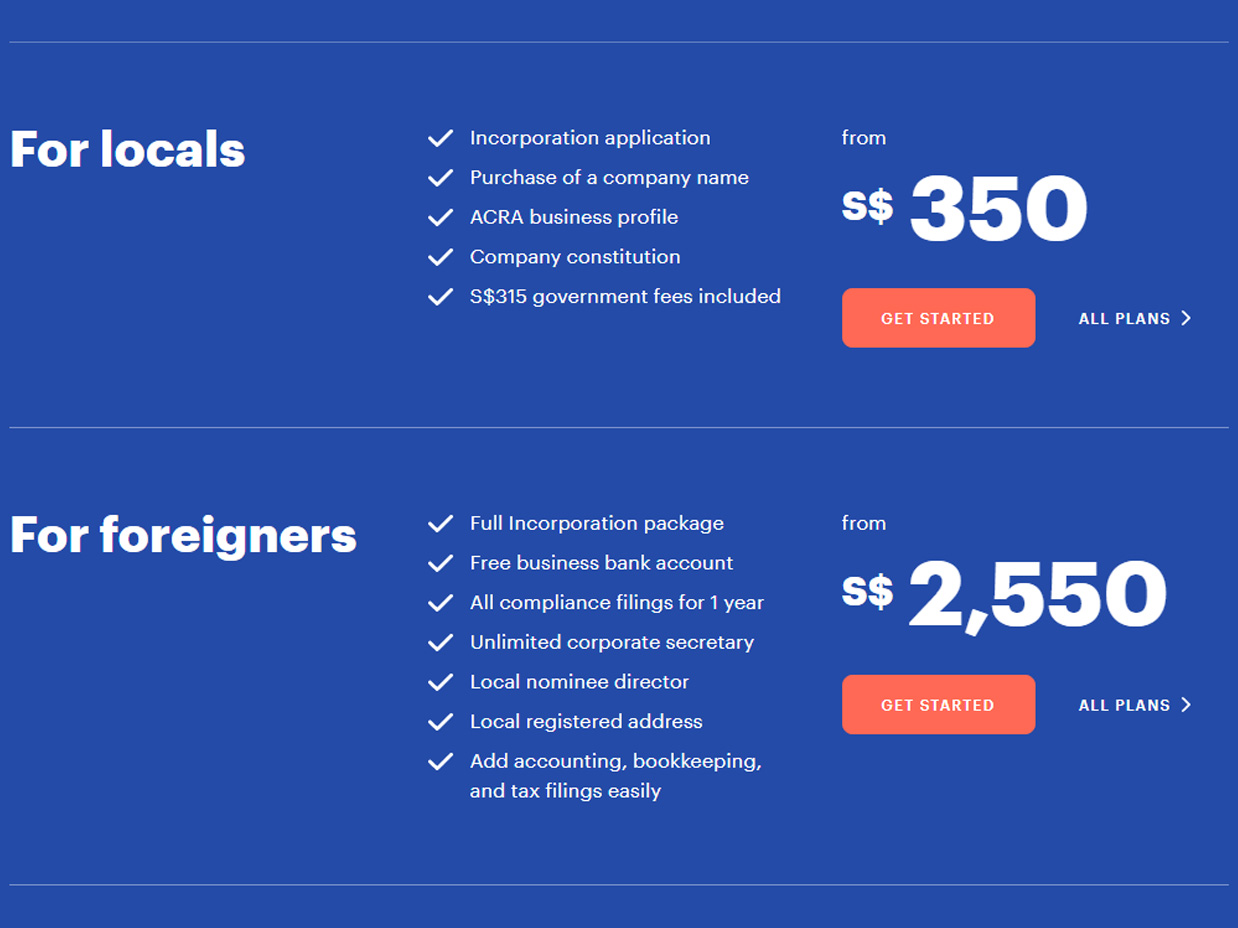

Incorporation

Get your company registered fast and online, and fast-tracked to a business account. All government fees and must-have services are included, for foreigners and Singapore locals.

Corporate Secretary

Your compliance in check. We track deadlines, file documents, and answer questions daily. All standard resolutions and routine filings are included in the plan.

Accounting and Taxation

A personal Chartered Accountant who gets to know your business: files reports, optimizes tax, and keeps books tamed. Get solutions for your industry and forget manual labor.

Photo

Services

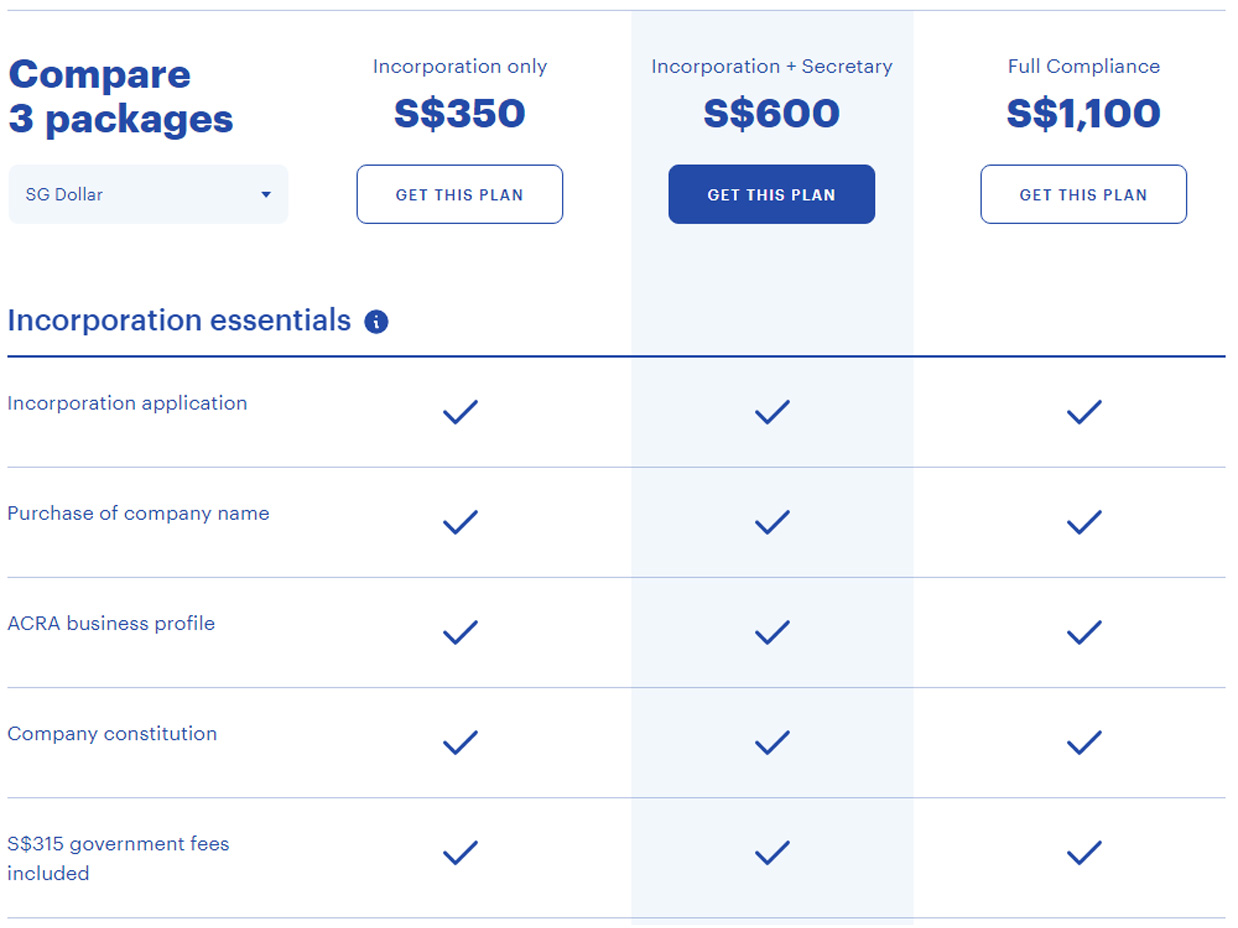

$245 Incorporation for locals. Incorporation only

Osome offers a company incorporation package for locals in Singapore. They will handle all the incorporation process from start to finish and the company experts will guide you through each step. They will handle checking and purchasing company names, preparing and processing incorporation application, company constitution, and ACRA business profile. Moreover, the company will act as legal representative for your company with the Accounting and Corporate Regulatory Authority. All government fees included.

$420 Incorporation for locals. Incorporation + Secretary

Osome delivers an incorporation and secretary package for locals in Singapore. The company experts will prepare and process incorporation application, purchase company name, prepare company constitution and ACRA business profile. Additionally, they will help with company secretary services such as corporate secretary routine Annual Filing and AGM preparation. Moreover, the package provides unlimited changes in company names, officers, address, business activity and others. All government fees included.

$771 Incorporation for locals. Full Compliance

Osome provides a full compliance package for locals in Singapore. The package includes incorporation, corporate secretary, accounting, tax and bookkeeping services. They will help with incorporation application, purchase of company name, ACRA business profile and company constitution. Corporate services include Annual Filing and AGM preparation, Annual Filing government fee, and unlimited changes in company name, officers and others. Also, company experts will handle Annual Management Report, Unaudited Financial Statements, Corporate Tax Return (Form C-S) and annual bookkeeping.

$1787 Incorporation for foreigners. All-in-one

Osome offers an incorporation package for foreigners in Singapore. The company will help with incorporation, business bank account, provides a compliance kit and accounting and tax services. Bank account opening is remote and takes 2 business hours. Compliance kit includes unlimited corporate secretary for 1 year, nominee director for 1 year, and registered address for 1 year. Osome provides accounting and tax services including review by Chartered Accountant, Annual Management Reports and covers monthly revenue under S$5k.

$1857 Incorporation for foreigners. Visa included

Osome provides incorporation, Visa and 1 year full compliance package. They will assist with incorporation, bank account, Employment Pass, accounting & tax and will provide a compliance kit. Employment Pass allows non-residents to work and live in Singapore. In case of failure the company will return 50% of the cost. Moreover, you will get unlimited corporate secretary for 1 year and nominee director for 6 months while the company applies for your Employment Pass.

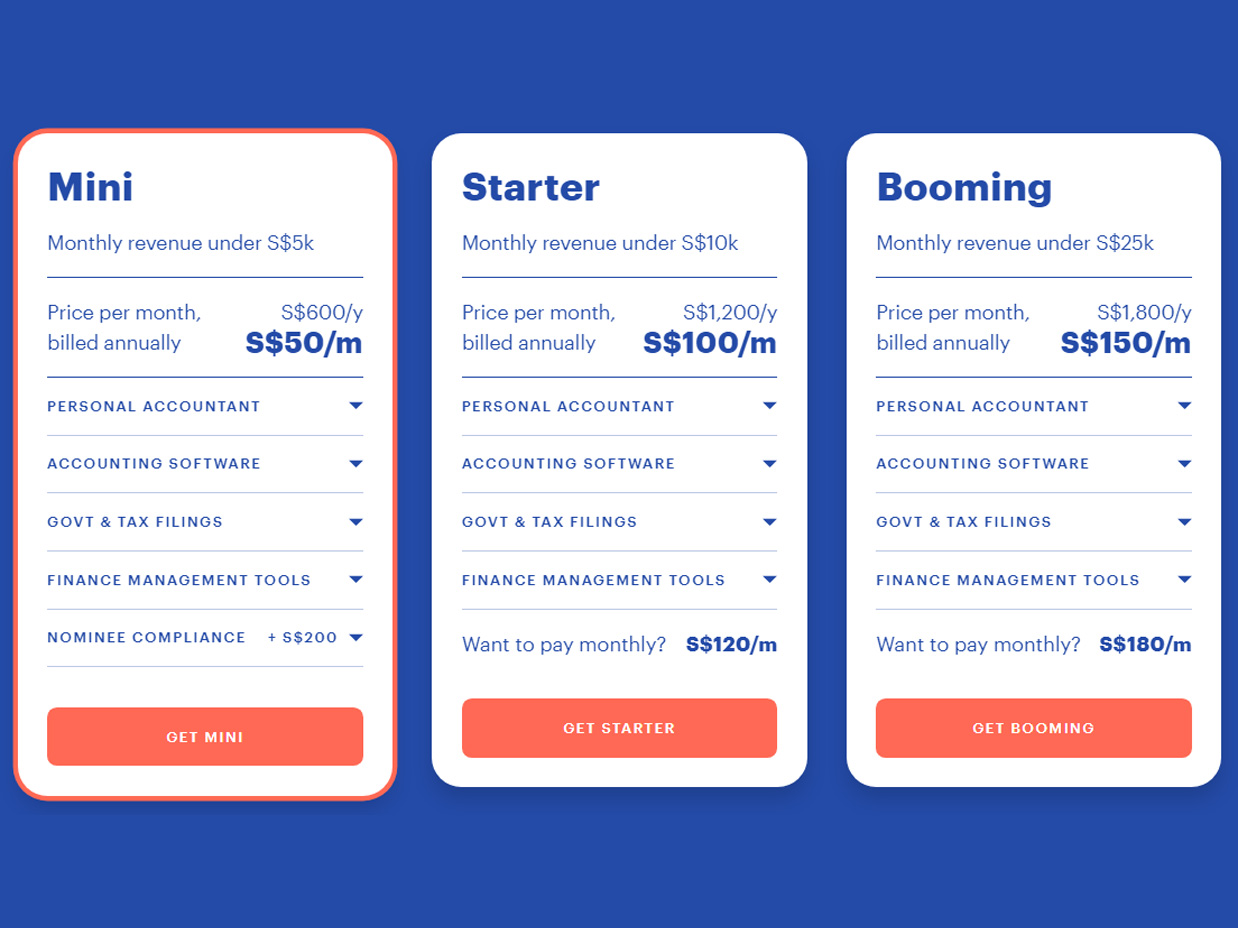

$35 Accounting Mini

Osome Accounting Mini package suits companies with monthly revenue under S$5k. The package includes personal accountant, accounting software, Govt & Tax Filings, finance management tools. With this package you will get personal accountant & bookkeeper, business growth & tax savings advice, in-app chat. Moreover, accounting software feature includes annual bookkeeping, bank connections and transaction reconciliation. For additional fee, Osome offers nominee compliance services.

$70 Accounting Starter

Accounting Starter package by Osome suits companies with monthly revenue under S$10k. The company will provide personal accountant (accountant & bookkeeper, business growth & tax savings advice, in-app chat) accounting software (bookkeeping, bank connections, transaction reconciliation), Govt & Tax Flings (Unaudited Financial Statements, Estimated Chargeable Income, Corporate Tax Return), finance management tools (automated cash balance, quarterly management reports and so on).

$105 Accounting Booming

Osome Accounting Booming package would be a great choice for companies with monthly revenue under S$25k. The package includes all necessary features such as personal accountant, accounting software, Govt & Tax Filings, and Finance management tools. The options to pay annually and monthly are also available.

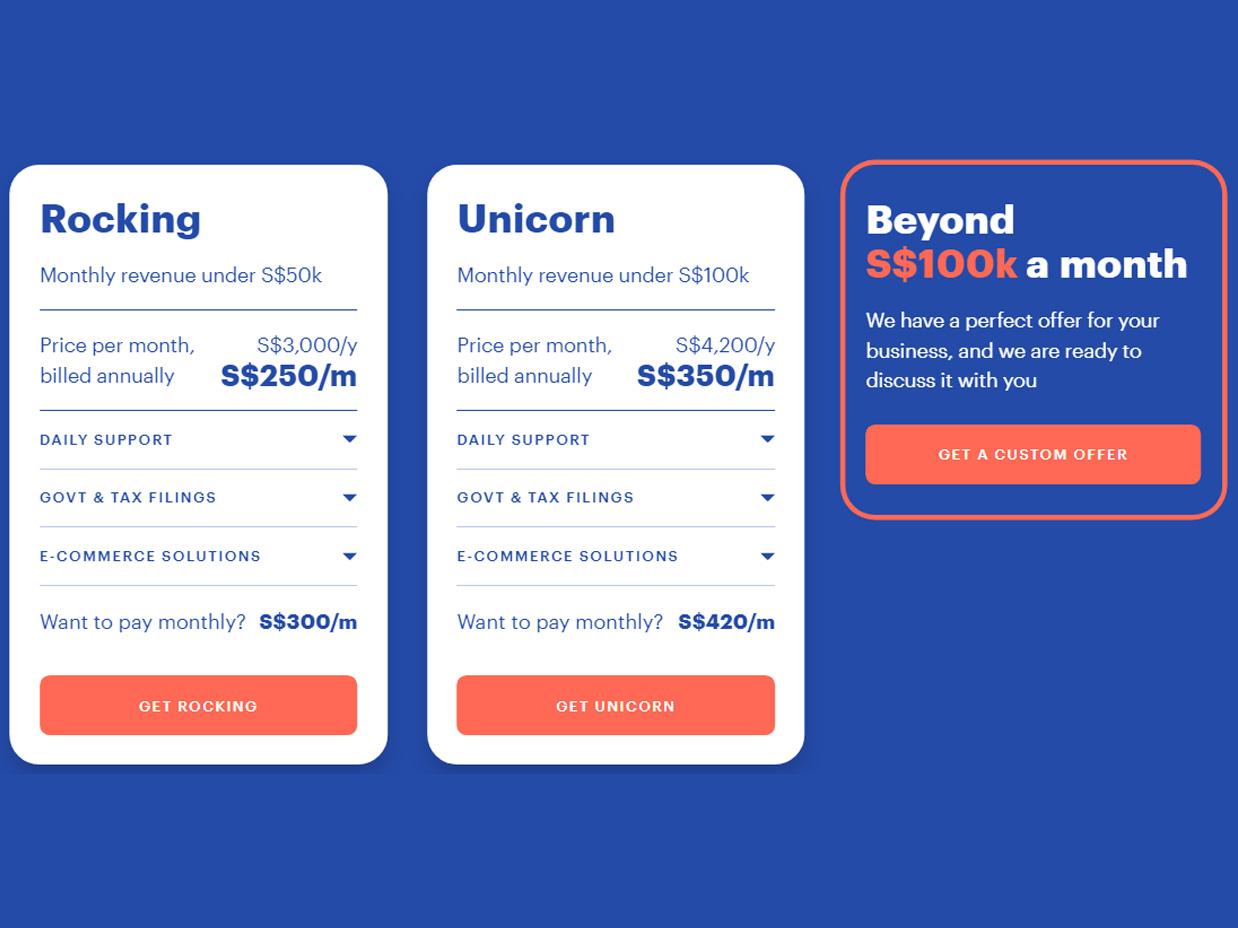

$175 Accounting Rocking

Accounting Rocking package offered by Osome is aimed at companies with monthly revenue under S$50k. The package includes all necessary features such as personal accountant & bookkeeper, accounting software, Govt & Tax filings, and finance management tools.

$246 Accounting Unicorn

Osome offers package for companies with monthly revenue under S$100k. Accounting Unicorn package includes personal accountant, in-app chat, accounting software, Govt & Tax Filings, and finance management tools. Finance management tools includes automated cash balance, invoice management & creation, monthly management reports, balance sheet, Ecommerce highlights and many more.

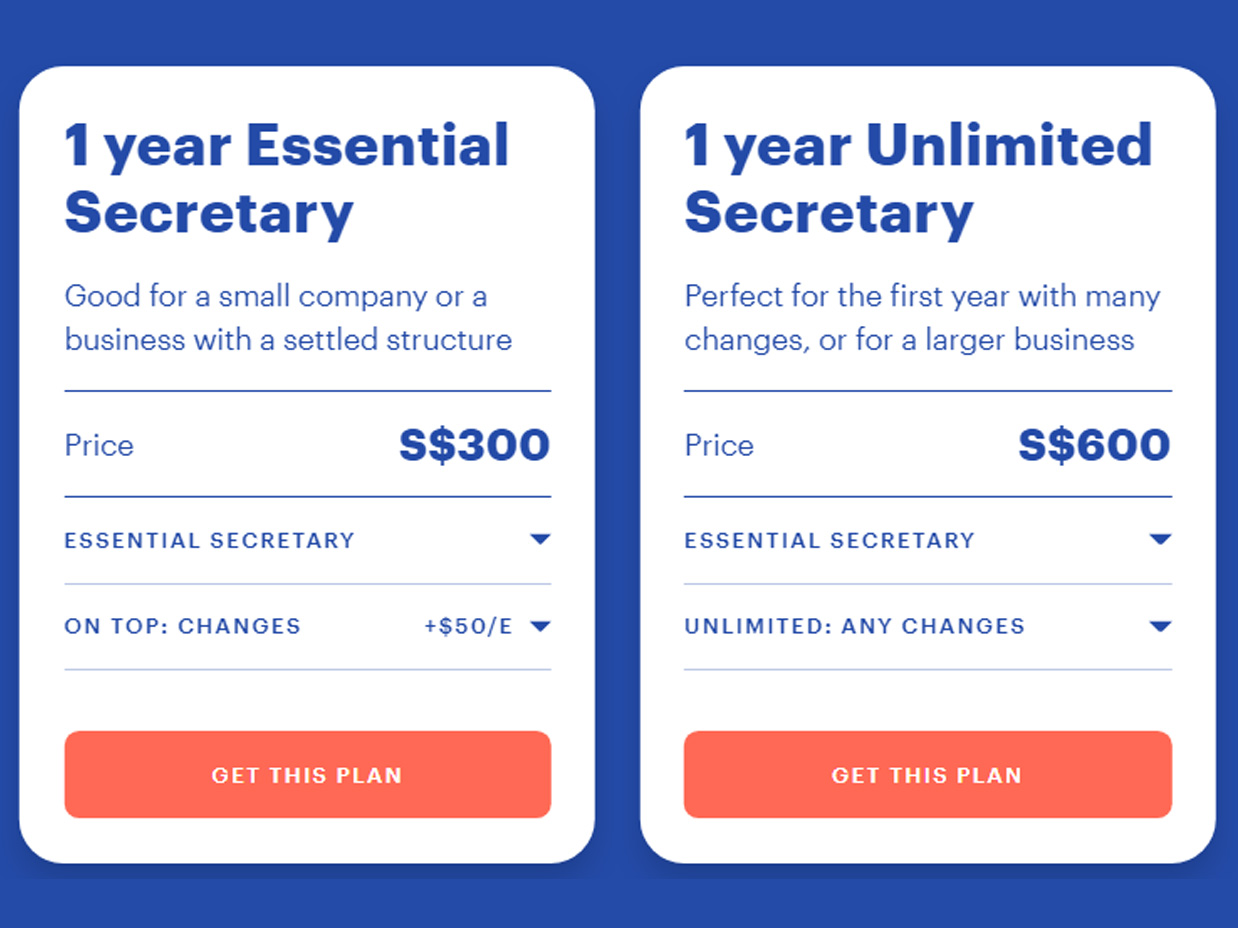

$211 1 year Essential Secretary

Osome provides a 1 Year Essential Secretary package that is good for small companies or businesses with a settled structure. The package includes Annual Filing government fee, corporate secretary routine Annual Filing and AGM preparation. For additional fee, the company provides non-share related changes, share related changes, and changes in corporate shareholders.

$422 1 year Unlimited Secretary

1 Year Unlimited Secretary package by Osome is perfect for the companies working first year or for larger businesses. The package includes Annual Filing government fee, preparation of Annual Filing and AGM. Moreover, the package includes changes in company name, officers, address, business activity, officers’ particulars. Also, it includes registration of particulars relating to changes, distribution of dividends, allotment of shares and transfer of shares (excluding Stamp Duty).

$562 Unaudited Financial Statements + Tax

Osome will help your business with Unaudited Financial Statements and Tax Filings. Preparation of Unaudited Financial Statements includes directors’ statement & report, statement of comprehensive income, statement of financial position, statement of cash flows, and notes to the financial statements. The company experts will handle your taxes and help with corporate tax, tax savings and tax advice.

$18 Payroll

Osome provides payroll services such as computation of gross to net salary and CPF, provision of payroll detail, provision of variance reports, disbursement of net salary and CPF. Additionally, they will help with preparation of year-end IR8A forms and appendices. The company experts will handle preparation of IR21, GML, NS MUP, CPF refund and government statistics forms. Moreover, the Osome team offers electronic administration of employees’ leave and expense claims.

$211 VAT registration

GST is a Goods and Services tax, or value‑added tax. GST registration in Singapore is compulsory if your company’s turnover is over S$1 million a year. The GST rate is 7%. The GST rate for the goods and services you sell to someone outside Singapore is 0%. A voluntary GST registration is also an option and might bring you perks. From 2020, GST is applied not only to the goods and services rendered in Singapore but also to some of those coming and going from overseas. Outsourcing bookkeeping and accounting can minimise the risk of missing the GST changes. It also helps you grasp the requirements and choose the most beneficial scenario for your particular type of business when dealing with GST.

Harold May

At first, I chose to work with them because they were competitively priced, but I was worried about the quality of the services. Then it turned out that the specialists there were even better than I expected, they helped me with files reports and tax optimization, and I’ll definitely keep working with them.

October 29, 2022

Jo Rawe

I’ve been planning to contact specialists in this field for a while, and choosing this company was a great decision, despite the minor issues. Overall, they didn’t affect the workflow, and all the needs were served, so I’m not disappointed with my choice.

November 25, 2022

Alfred Enoch

Realistic assessment with no empty promises, and I’d say that’s what I really appreciate. It didn’t take long for me to get the result I needed, and I’ll definitely continue working with these specialists to keep getting the best solutions in that field, and that’s not something you can easily find.

November 29, 2022

Robert Malz

I can tell you that my case was rather simple, but still handled in a timely manner and saved me the headache of trying to do everything myself. There’s always scope for development, and I’m not sure if I contacted them with more serious issues, but they seemed pretty professional, to be honest.

December 1, 2022

Peter Doile

Manual accounting was taking too much of my time, and I can say that finding the best company to work with was a real challenge. Eventually, I managed to find Osome, and I understood that such a company was a salvation to me. We got in touch pretty fast, and by far, our cooperation has been great, so I’m glad I chose that company to help me with accounting.

December 27, 2022

George Hull

I’m finally able to focus on the important aspects of growing a business, and relying on this company was a great decision for my startup. They actually track the deadlines and deliver all their client’s needs, so I highly recommend learning more about them and consider contacting these specialists.

December 28, 2022