ZE Global Accounting and Audit

Description

ZE Global Accounting & Audit provides bookkeeping services, tax services, business management, audit & preparation of unaudited financial statements. They have professionally qualified staff (from Singapore relevant bodies ACCA, CPA, CA), and keep track of the latest standards and regulations.

ZE Global provides accounting services, and they will prepare profit projections, provide bookkeeping & payroll services, prepare general ledger & financial statements, make cash flow forecasts, and assist with general accounting advisory.

Bookkeeping services provided by ZE GLobal include managing general ledger, preparing bank reconciliation, maintaining accounts payable & receivable, preparing fixed assets schedule and yearly management accounts (balance sheet, debtors & creditors aging, journal listing, profit & loss, and bank reconciliation report).

The company offers audit & assurance services such as statutory audit, expenses audit, internal audit, non-corporate entities audit (associations, registered charities, partnerships, and clubs), due diligence, rental audit, sales audit, and gross turnover audit.

ZE Global provides tax services, and they will help you with individual and corporate tax planning, advise you on different tax matters, prepare and fill up tax returns forms (partnership, company, sole proprietor, and individual).

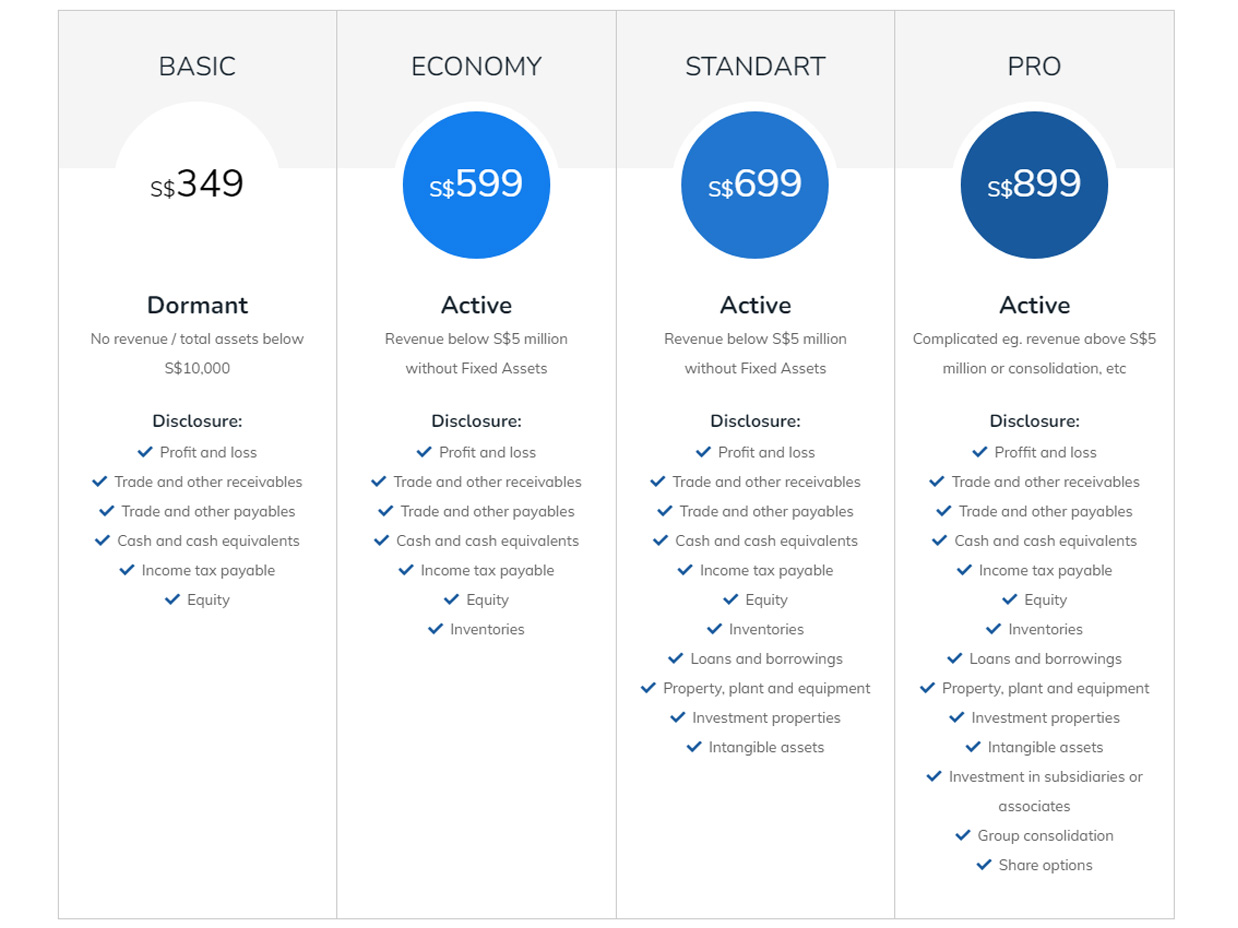

Also, they will prepare eXtensible Business Reporting Language according to Singapore Financial Reporting Standards. Financial statement disclosures include trade and other receivables & payables, income tax payable, profit & loss, equity, cash & cash equivalents, bill payables, intangible assets, and others.

Photo

Services

$248 Accounting

At ZE Global, we ensure you remain on top of your accounting and business processes with our superior accounting and bookkeeping services. Our experts are professionally equipped with all the skills, qualifications, and industry knowledge to provide you with optimum accounting and bookkeeping services.

$71 Bookkeeping M-25

25 entries / month Manage general ledger Maintain account payable Maintain account receivable Prepare bank reconcilation Prepare fixed assets schedule Record journal entries Prepare management account: Profit and loss Balance Sheet Detail general ledger Debtors aging Creditors aging Journal listing Bank reconcilation report

$114 Bookkeeping M-50

50 entries / month Manage general ledger Maintain account payable Maintain account receivable Prepare bank reconcilation Prepare fixed assets schedule Record journal entries Prepare management account: Profit and loss Balance Sheet Detail general ledger Debtors aging Creditors aging Journal listing Bank reconcilation report

$227 Bookkeeping M-100

100 entries / month Manage general ledger Maintain account payable Maintain account receivable Prepare bank reconcilation Prepare fixed assets schedule Record journal entries Prepare management account: Profit and loss Balance Sheet Detail general ledger Debtors aging Creditors aging Journal listing Bank reconcilation report

$476 Bookkeeping M-200

200 entries / month Manage general ledger Maintain account payable Maintain account receivable Prepare bank reconcilation Prepare fixed assets schedule Record journal entries Prepare management account: Profit and loss Balance Sheet Detail general ledger Debtors aging Creditors aging Journal listing Bank reconcilation report

$567 Auditing

At ZE Global, we provide our clients with mid-tier auditing solutions in Singapore. With a focus on small and medium-sized enterprises, we deliver professional auditing services. ZE Global's highly renowned audit services allow companies to attain an exceptional level of transparency along with a better financial understanding of the business. Moreover, our services enable you to view your financial records including assessment through analysis, financial irregularities, fraud predictions, and other business processing. Our audit services are intended to help you opt for the best alternative.

$53 Payroll

Our payroll services are equipped with an in-depth understanding of MOM and CPF regulation among other official authorities. We adhere to the deadlines provided as per the law of monthly submissions.

$462 VAT

GST registration can be grouped into compulsory registration and voluntary registration. Compulsory. A business must register for GST when: Your taxable turnover for the past 12 months is more than $1 million; or You can resonably expect your taxable turnover in the next 12 months to be more than S$1 million. Voluntary. Even without S$ 1 million, a business can still register for GST subject to approval by IRAS.

Greg Kolm

They are definitely the best people to handle IRAS issues, and I’ll continue working with these specialists for sure. They managed to solve my case in almost no time, and I’m glad I decided to turn to them because I had a few companies on my mind, but I definitely chose the best option.

November 28, 2022

Thomas Robins

Working with ZE Global accounting and audit was incredible, specialists there are actually professional and knowledgeable, and it didn’t take them long to figure everything out and solve my problems with taxes. I’ll keep on working with them and explore other services that they can provide.

November 30, 2022