Williams Accounting & Consulting

Description

Williams Accounting & Consulting is a US-accounting company that was founded in 2005. The company has offices in Louisiana and Georgia. They provide an extensive range of services to business that include bookkeeping, business consulting, business formation, full service payroll, sales tax services, tax preparation, tax resolution and others.

Accounting services include financial statements, financial reports, accounts receivable and bill pay, payroll processing, categorizing of transactions, reconciling business accounts, production detailed financial reports, and tax preparation services (including sales taxes).

Payroll services provided by Williams Accounting & Consulting include issuing checks and direct deposits, handling payroll taxes and deductions, dealing with employee benefits, tracking of monthly expenses, and ensuring full compliance with payroll laws.

Also, the company offers sales tax services that include sales tax compliance, sales tax consulting and sales tax audit defense.

Williams Accounting & Consulting delivers tax resolution services such as IRS audits, non-filing of prior tax returns, back tax owed to the IRS, payroll tax issues, and IRS liens/levies/garnishments. Also, they can help with property & asset seizures, payment plans, and offer in compromise.

Moreover, the company provides tax planning services for businesses that include advice on business structure, guidance with overall tax strategy, personalized planning, and accounting & tax preparation. Additionally, they can help with tax planning for medical and health industry businesses (accounting, medical CFO services and tax resolution).

Williams Accounting & Consulting provides business formation across all industries such as medical, legal, real estate, trucking and others.

Photo

Services

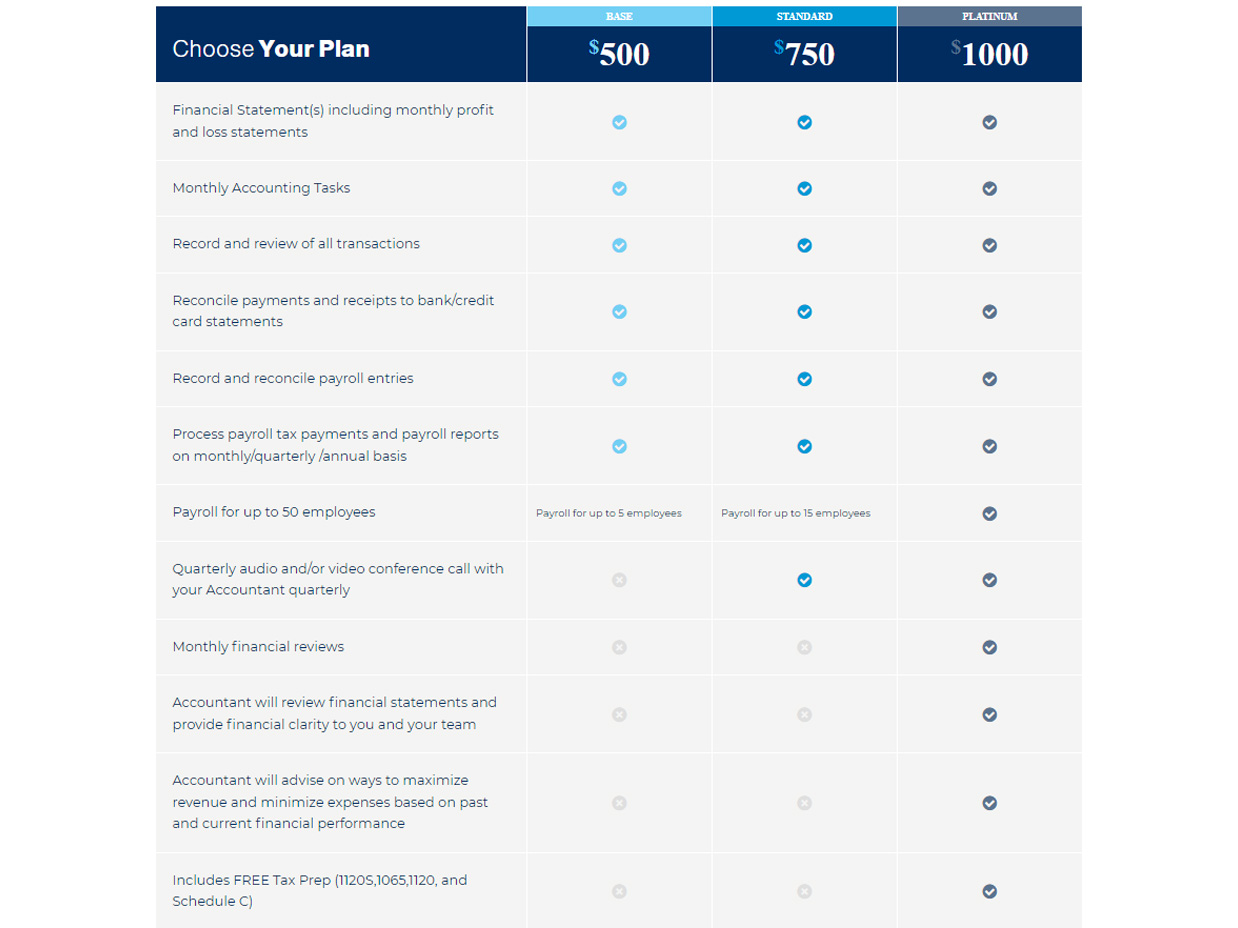

$500 Accounting BASE

Financial Statement(s) including monthly profit and loss statements Monthly Accounting Tasks Record and review of all transactions Reconcile payments and receipts to bank/credit card statements Record and reconcile payroll entries Process payroll tax payments and payroll reports on monthly/quarterly /annual basis

$750 Accounting STANDARD

Financial Statement(s) including monthly profit and loss statements Monthly Accounting Tasks Record and review of all transactions Reconcile payments and receipts to bank/credit card statements Record and reconcile payroll entries Process payroll tax payments and payroll reports on monthly/quarterly /annual basis Payroll for up to 15 employees Quarterly audio and/or video conference call with your Accountant quarterly Tracking of monthly expenses up to $25K per month Tracking of monthly expenses from $25k - $100K per month

$1000 Accounting PLATINUM

Financial Statement(s) including monthly profit and loss statements Monthly Accounting Tasks Record and review of all transactions Reconcile payments and receipts to bank/credit card statements Record and reconcile payroll entries Process payroll tax payments and payroll reports on monthly/quarterly /annual basis Payroll for up to 50 employees Payroll for up to 5 employees Payroll for up to 15 employees Quarterly audio and/or video conference call with your Accountant quarterly Monthly financial reviews Accountant will review financial statements and provide financial clarity to you and your team Accountant will advise on ways to maximize revenue and minimize expenses based on past and current financial performance Includes FREE Tax Prep (1120S,1065,1120, and Schedule C)Tracking of monthly expenses from $100K - 200K per month

Bookkeeping

If your business needs specialized bookkeeping, including property tracking, third party revenue collection, cash revenue and cash expense tracking then you’re in the right place. Just add the WAC Addition to any package for only $83 per month.

Payroll

As an entrepreneur and business owner, our CEO Donald E. Williams understands how challenging it can be to balance all of the day-to-day tasks of running a company. In the modern business world, payroll is necessary, complicated, and time consuming. Businesses need accurate numbers. Our mission is to provide comprehensive, cost effective payroll services so that business owners and entrepreneurs can better focus on running and growing their company.

Tax

At Williams Accounting & Consulting, our Atlanta sales tax accounting professionals are skilled, detail-focused advocates for businesses and organizations in Georgia. We know that sales tax compliance has become a complex and confusing burden for business owners—let us take the pressure off you and your team. We specialize in accounting and tax preparation. For a completely confidential consultation with an experienced sales tax consultant, please call us at (404) 948-3903 or send us a message directly online.