Teo Liang Chye PAC

Description

Teo Liang Chye PAC is a Singapore-based chartered accountant firm that helps small and medium businesses. They provide services such as auditing, taxation, accounting, corporate secretarial services, and many others.

The company’s auditing services include statutory audits, non-statutory audits, due diligence, and review of internal controls.

Their corporate tax services include preparation of tax computations, filing of corporate income tax returns, withholding tax compliance, tax incentive application & optimization, and application for advanced tax rulings. Also, they can help with corporate tax planning to maximize tax efficiency, assist with Inland Revenue Authority of Singapore tax audits or tax investigation issues, respond to IRAS queries on tax compliance matters, pre-IPO & tax due diligence reviews, and transaction tax advisory for M&A.

Personal tax services include individual tax computations for individuals, preparation of personal income tax returns, preparation of returns of employee’s remuneration & tax clearance, assistance with expatriate taxation, assistance with IRAS queries, application to IRAS for voluntary disclosure of past tax errors, and personal tax planning & advisory.

Teo Liang Chye PAC offers GST services such as GST registration for new businesses, preparation & filing of GST returns within the prescribed due date, conducting an Assisted Self-Help Kit self-assessment compliance review, and assisting with voluntary disclosure of errors under the IRAS. Moreover, company experts will help to conduct an Assisted Compliance Assurance Programme review, application for the Major Exporter Scheme & its renewal, GST health check, GST advisory services, assistance with IRAS queries, and dispute resolution on GST matters.

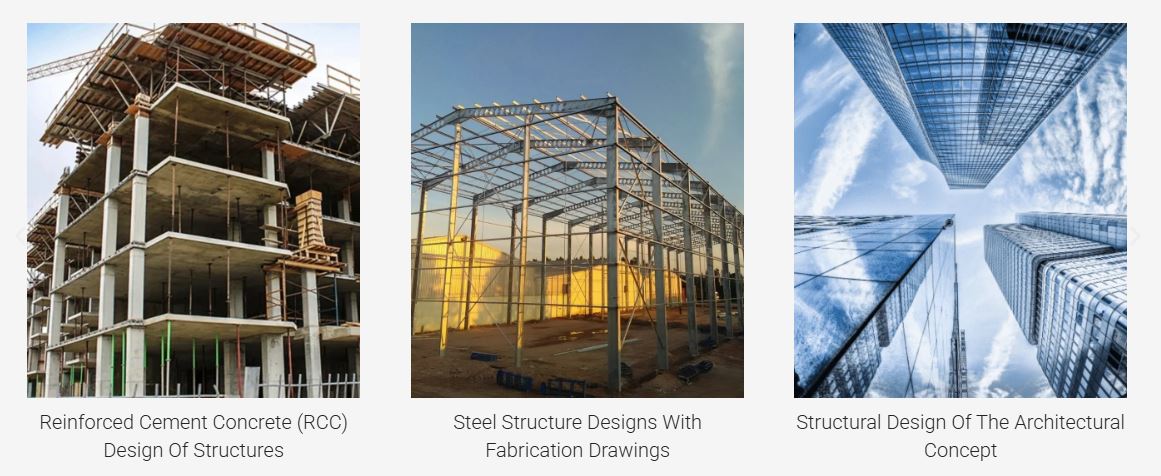

Photo

Services

Accounting

Businesses in Singapore are legally required to keep proper records and accounts of business and financial transactions. Staying on top of your accounting duties will enable you to fulfill your compliance and financial reporting obligations with regulatory authorities such as Accounting and Corporate Regulatory Authority (ACRA) and Inland Revenue Authority of Singapore (IRAS). The preparation of accurate accounts will also help you to gain better insights into the financial health of your business. For us, accounting is more than just bookkeeping. We bring the numbers to life so that you can understand what they mean for your business, allowing you to make better business decisions.

Auditing

In today’s demanding regulatory environment, businesses face increasingly complex risks. You need to uphold the integrity of your financial information to build credibility and gain trust. An independent, external audit of the reliability of your financial statements adds value to your business by promoting accountability, enhancing corporate governance and instilling confidence amongst your stakeholders. At Teo Liang Chye PAC, integrity and professionalism underpin our audit and assurance services. We adopt a disciplined approach to provide an unbiased and objective assessment of your financial statements. In delivering a quality audit, we add value to your business so that you can make informed decisions, take steps to resolve risks and move forward with confidence.

Secretary

Companies incorporated in Singapore are required by law to comply with the requirements of the Singapore Companies’ Act. You need a company secretary who has the knowledge and experience to navigate the complexities of the statutory and legal framework so you can fulfill your compliance obligations amidst a competitive business landscape. At Teo Liang Chye PAC, we possess an in-depth understanding of the statutory corporate governance and compliance requirements. We are well-qualified to handle all your corporate secretarial matters to ensure the smooth running of your business.

Tax

Today’s businesses operate in an ever-shifting tax landscape. Companies need to deal with increasingly complex tax laws and heightened scrutiny on their tax affairs while managing multiple agendas and priorities. You need to fulfill your tax compliance obligations while minimising tax risk, and meet your tax objectives while maximising tax planning opportunities. Our tax services team has sound, technical knowledge as well as deep, practical experience. We understand your business strategies and goals and adopt a pro-active approach in helping you with your tax needs.

0 Reviews

Write a Review

Warning: min(): Array must contain at least one element in /home/u643854039/domains/incorporatebusinessonline.net/public_html/wp-content/themes/findall-child/functions.php on line 671