Singapore Corporate Services

Description

Singapore Corporate Services is a one-stop corporate service provider with more than 20 years of experience. They help small and medium businesses with business processes and provide such services as bookkeeping & accounting, income tax services, company secretarial, audit, and XBRL financial report services.

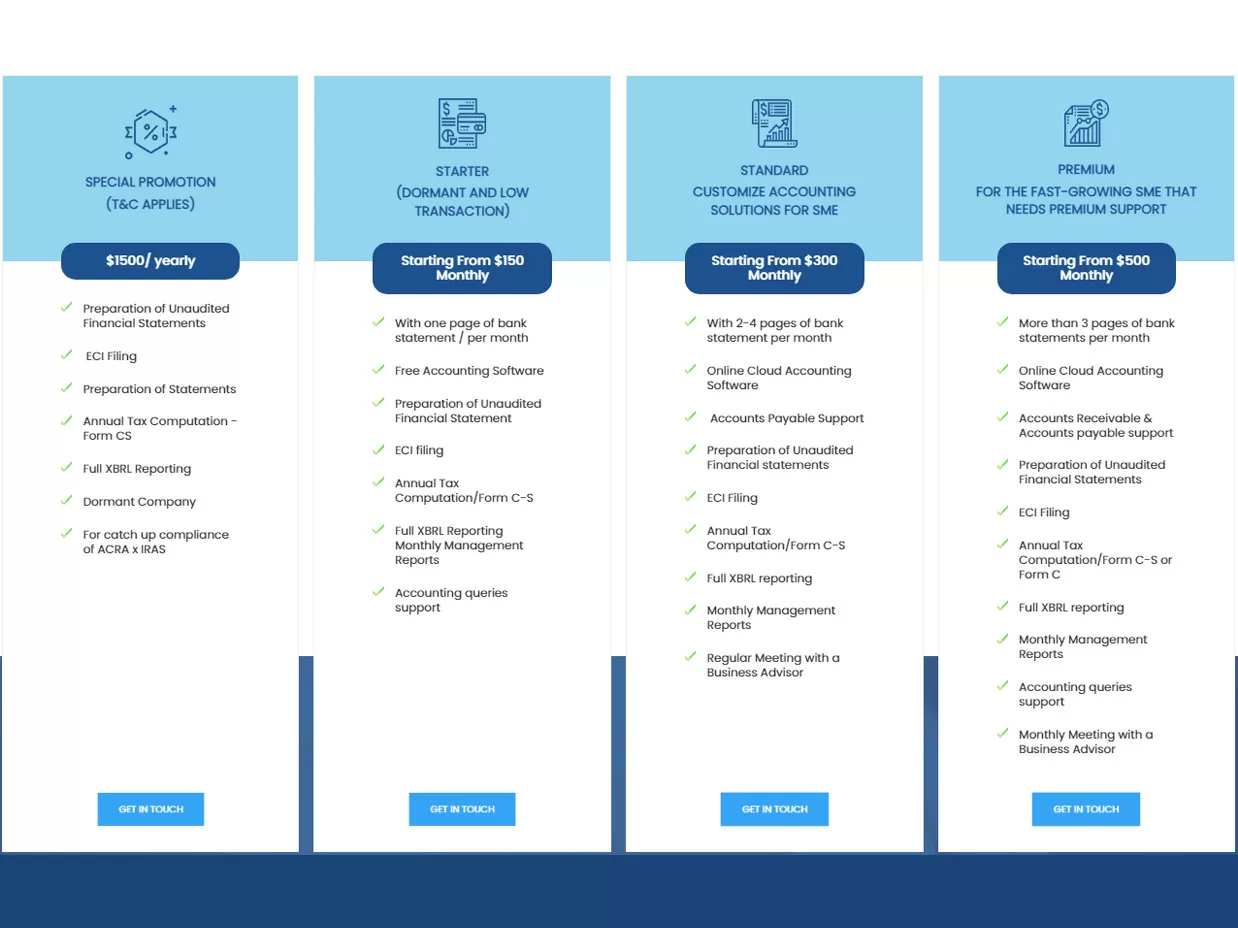

Bookkeeping and accounting services package provided by SCS include bank statements, online cloud accounting software, accounts receivable & payable support, preparation of unaudited financial statements, Estimated Chargeable Income filing, annual tax computation (Form C and Form C-S), full XBRl reporting, management reports, accounting queries support, meeting with a business advisor.

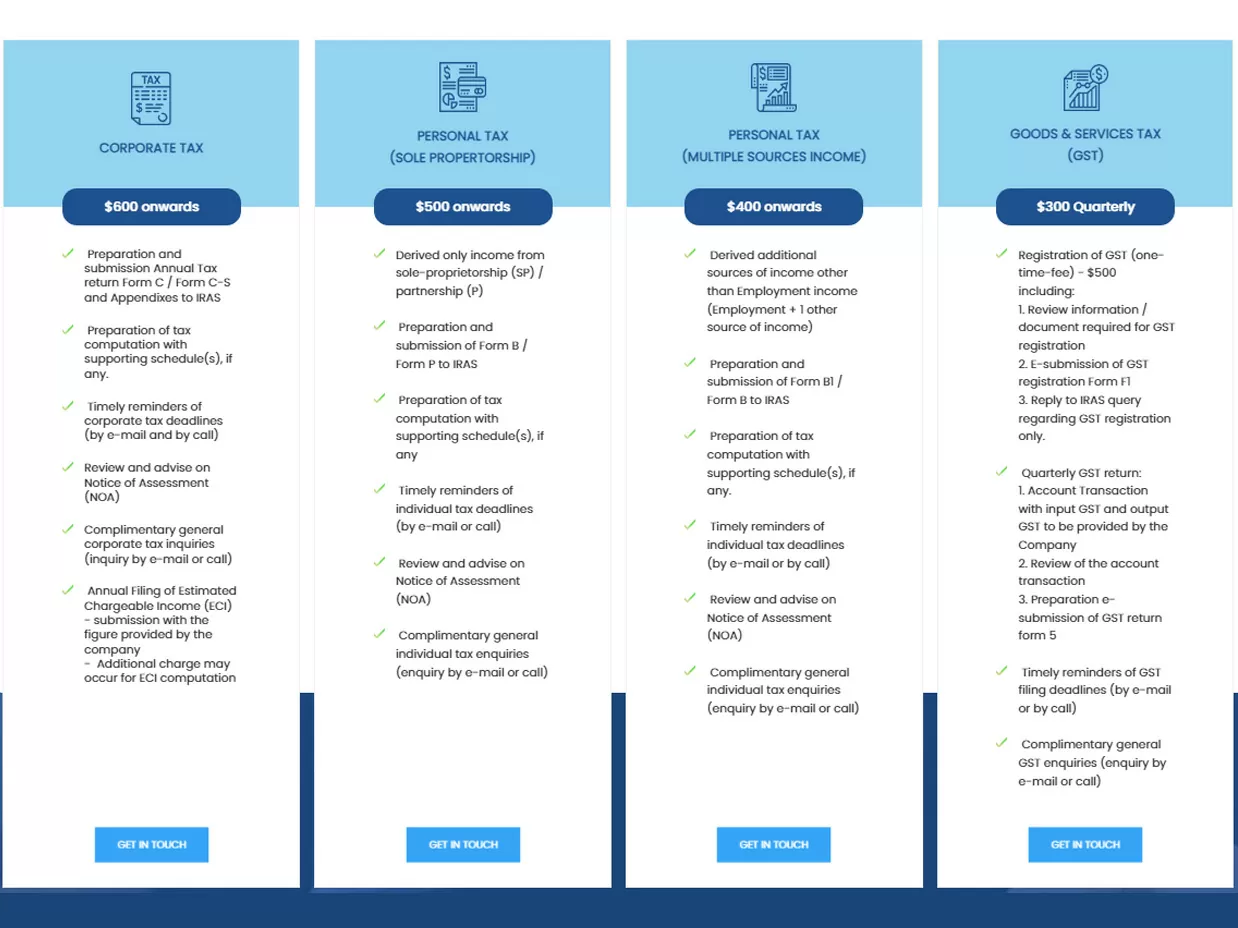

SCS provides corporate income tax services such as preparation & filing of income tax return, tax computation, application for tax ruling & tax incentives, and assistance in corporate tax planning. Also, SCS will handle tax objections and disputes and will attend to IRAS. The company’s experts will assist you with withholding tax compliance, managing tax for dormant companies, and advising you on corporate income tax-related issues. Additionally, SCS experts will help you with personal tax (preparation of Form B & Form P to IRAS, review & advise on Notice of Assessment, and so on).

SCS provides sales audit services such as inventory management, product marketing, store promotions, and customer research.

SCS XBRL financial report services include financial statement highlight and full financial statements (dormant, active Pte Ltd, and consol).

Singapore Corporate Services offer a company secretarial package that includes preparation of Annual General Meeting, submission of annual return for Private limited Companies, approval of director fees, and updating of directors particulars with ACRA.

Photo

Services

$108 Accounting

At SCS accounting, our team uses cloud-based accounting software to streamline your records and generate consistent financial reports. As a Xero Certified Advisor (Gold Partner), we focus on small business bookkeeping and accounting services with certified public accountants to guide you every step of the way. With us on your side, you can stay on top of the financial information you need to keep your business moving forward. And what’s the cost for outsourcing your bookkeeping? — less than hiring an in-house position!

Auditing

We get it. Audits can be a real pain. The deadlines come at the worst times, the reports are time-consuming and you’d rather be doing anything else. And to make things worse, there’s always anxiety after you submit your documents, wondering if you got it right. Top audit firms in Singapore charge an arm and a leg for their services and are out of reach for small businesses. With that in mind, are SMEs destined to be stuck doing their own audit planning? Not quite! As an SME-focused audit firm, our qualified professional team supports you to make company audits a breeze and a great way to understand your business risks. Tap on the expertise of our auditors as they work with you to devise a practical audit solution for your business — one that is cost-effective and on time.

Secretary

How long does it take to register a company in Singapore? What are the steps to incorporating a company in Singapore? Which local regulations do I need to pay attention to? Whether you’re a foreigner registering a company in Singapore or a local looking to set up a private limited company, there are many little tasks that lead up to setting up a business in Singapore. To make matters worse, there’s also an overwhelming number of regulations and statutory deadlines to remember. It can seem impossible for both entrepreneurs and international companies looking to start up a company in Singapore to navigate these complex laws. Not impossible if you outsource to the right secretarial services team! Led by our senior corporate advisor, a Chartered Secretary registered SIACSA and ACRA registered filing agent with over 10 years in the industry — get up and running in no time at all with our online company secretary services to help you seamlessly register and set up a company in Singapore.

$216 Tax

Missing out on corporate income tax rebates, benefits and deductibles can feel like you’re leaving money on the table. And you are! These are returns that can be better channelled into your growth. Small businesses are often confused by how to perform tax computation and tax filing according to IRAS standards. Are you often asking yourself these questions: How do I calculate my corporate tax? How do I e-file my taxes and GST returns? What kind of tax returns and rebates are applicable to me? We’re here to answer these questions and ensure you don’t miss out on what you’re entitled to. Speak to our tax agent to work out how you can meet your company’s tax filing obligations and maximise your tax returns at the same time.