Description

Pilot is business accounting and general ledger software designed to help start-ups and small businesses manage accounting, taxes, and other financial processes. Administrators can report various income taxes, including federal, state, and local taxes, and receive status updates regarding supplies in real-time.

The platform enables teams to manage annual budgeting, investor reporting, field assessments, fundraising strategies, forecasting, and other professional services. Pilot allows managers to analyze transactions and generate monthly financial reports, including profit and loss, cash flow, and balance sheet. Operators can also calculate consumption rates and share inventory updates with online retailers.

Pilot allows businesses to process invoices, create and share invoices with relevant staff, track expenses, create budgets, and analyze business financial health. Employees can also identify R&D expense reports and collect supporting documents to claim tax credits.

CFO services provided by Pilot include a review of your financial health & processes, financial forecast, conducting strategic analyses, maintenance & enhancement of operating budget, supporting vendor contract review, and recommendations for sales efficiency & retention.

Moreover, Pilot provides annual budgeting & forecasting services and will prepare forecasts for revenue, employee expenses, COGS, operating expenses, and more.

Pilot offers additional tax services such as additional city & state income tax filing, 1099-NEC filing preparation, Foreign subsidies 5471, foreign shareholder return 5472, low-activity years tax filing, and foreign financial accounts.

Photo

Services

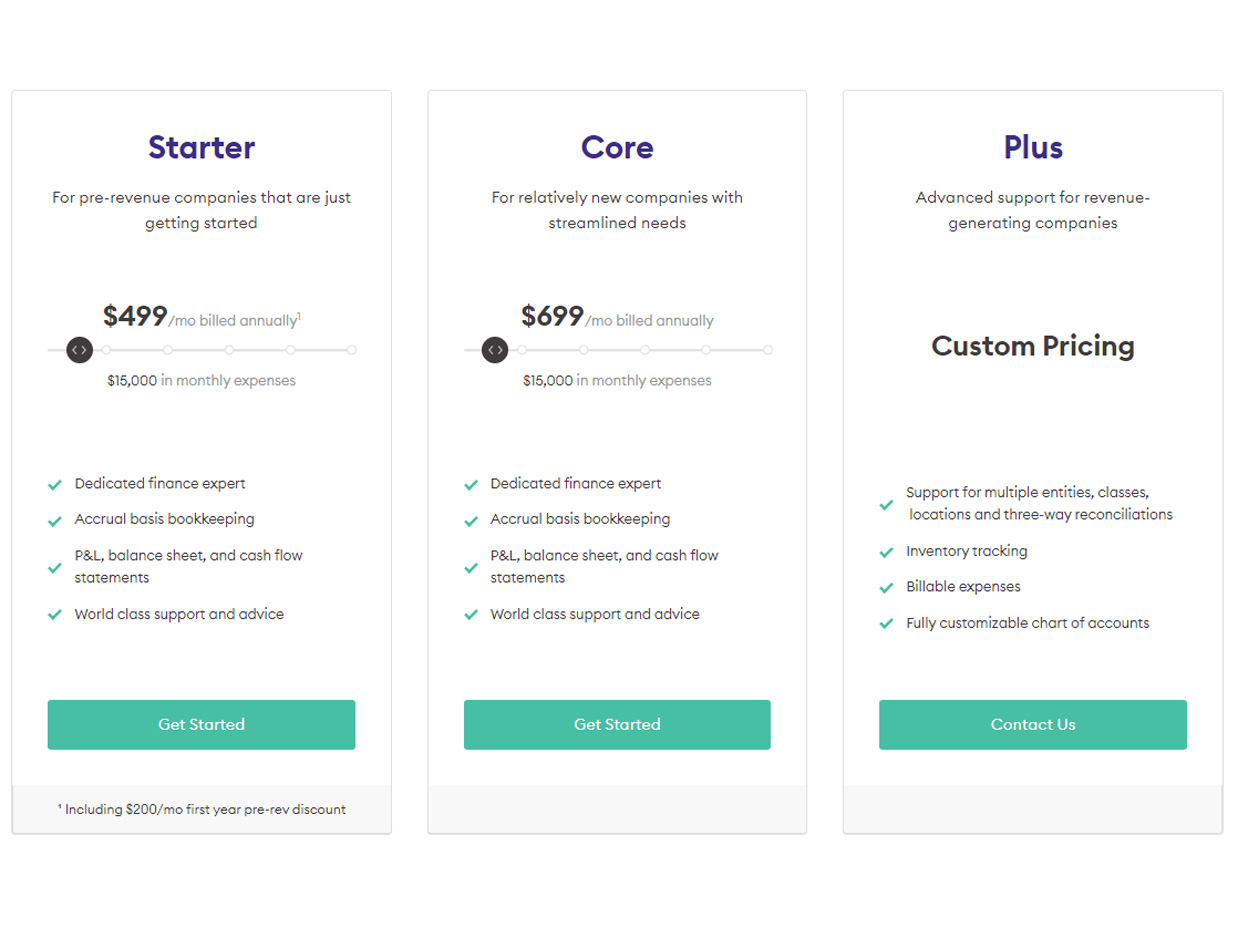

$599 Bookkeeping Core

Dedicated finance expert Accrual basis bookkeeping P&L, balance sheet, and cash flow statements World class support and advice

$849 Bookkeeping Select

Dedicated finance expert Accrual basis bookkeeping P&L, balance sheet, and cash flow statements World class support and advice Industry standard financial ratios Expedited books delivery Monthly phone reviews Priority support

$162 Tax Essentials

Support for unprofitable C corps Federal corporate income tax filing State corporate income tax filing Delaware Franchise tax filing 1099-NEC filing Email support Free tax extension

$5000 Fundraising Strategy & Support

A fundraising strategy from experts who’ve done it before. Our CFOs can help you with: Check mark icon Overall fundraising strategy and approach Check mark icon Comprehensive pitch narrative, deck design, and mock pitch sessions Check mark icon Financial and market analyses

$1350 Monthly Engagement

Monthly updates of your financials and business metrics Monthly rolling forecasts of financials

$8100 Annual Budgeting & Forecasting

Personal CFO Consultations Revenue projections COGS budget Headcount budget Payroll budget Non-payroll budget Forecast drivers based on historical trends, financial ratios, or custom inputs Sensitivity analysis Scenario planning Robust three statement models

Robert Young

They provide you with wonderful step by step assistance and support, and that’s not something you experience with many companies. I’ve used their services for years, and no plans to change for sure, so they’re definitely worth working with, I don’t even doubt that.

November 30, 2022

William

I didn’t expect much from working with these specialists, and I can tell you that I just got all my needs served, and that’s what was important for me the most. I wouldn’t say these specialists are outstanding, but they actually provide you with good services for a fair price.

December 1, 2022

Wayne Phillips

I’d say that working with this company wasn’t bad at all, and I think I’ll keep working with these experts because it’s hard to find someone decent in this field nowadays. I’m not sure whether it would be better for me to hire an in-house specialist, but in general, I’m quite satisfied with the services of this company.

December 27, 2022

Tony McCarthy

I started running a business not so long ago, and I have to say that the impact of this company on my business development was actually impressive. By far, I didn’t have any problems, these specialists get work done correctly, and always kept me informed, so I’m not planning to turn to anyone else.

December 29, 2022