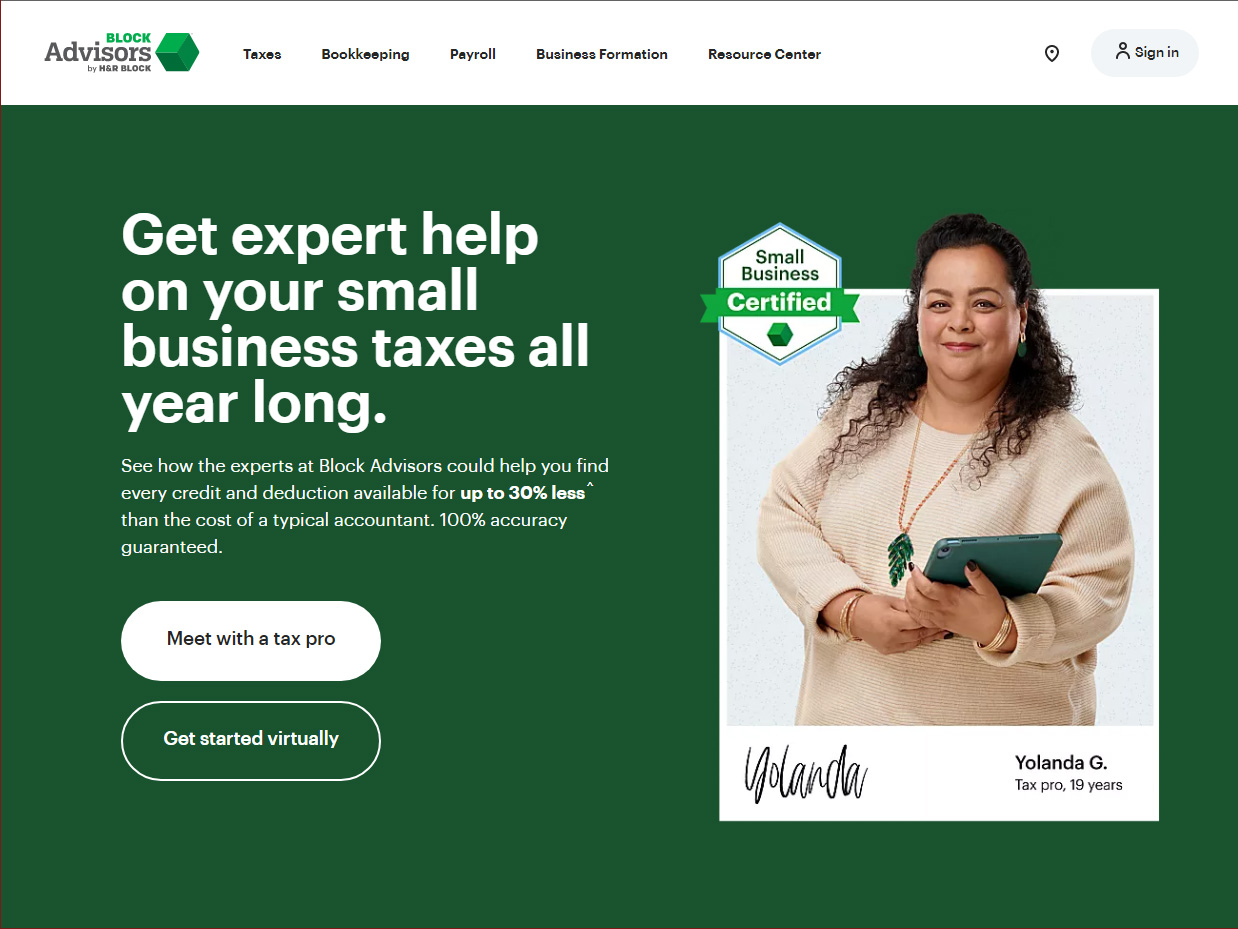

Block Advisors

Description

Block Advisors is a corporate service provider company that is located in the US. They provide help to small and medium businesses with such routine tasks as accounting, taxes, bookkeeping, and payroll.

The company offers tax services such as tax filing for self-employed, S and C Corporations, and partnerships. They can help with a wide range of forms that include Form 1040, Schedule C, Form 1120S, Form 1120, and Form 1065. The company guarantees 100% accuracy, offers year-round tax support, and has state and local expertise. Their tax pros are up-to-date on federal, state, and local taxes. Also, the tax pros have specialized training in small business taxes, are available year-round, and have an average of 12 years of experience.

Bookkeeping service packages provided by Block Advisors include guidance from a dedicated account manager, on-demand access to Xero, and an action plan created each quarter. Additionally, you will get monthly reconciliation delivered to your inbox, quarterly support with on-demand access to expert help, 30-minute consultation with an account manager, a review of your books year-to-date, and access to virtual and in-person help. Also, you will get full-service onboarding to Xero, assistance in setting up a consolidated view of all accounts, financial statement creation and delivery, and real-time transaction categorization.

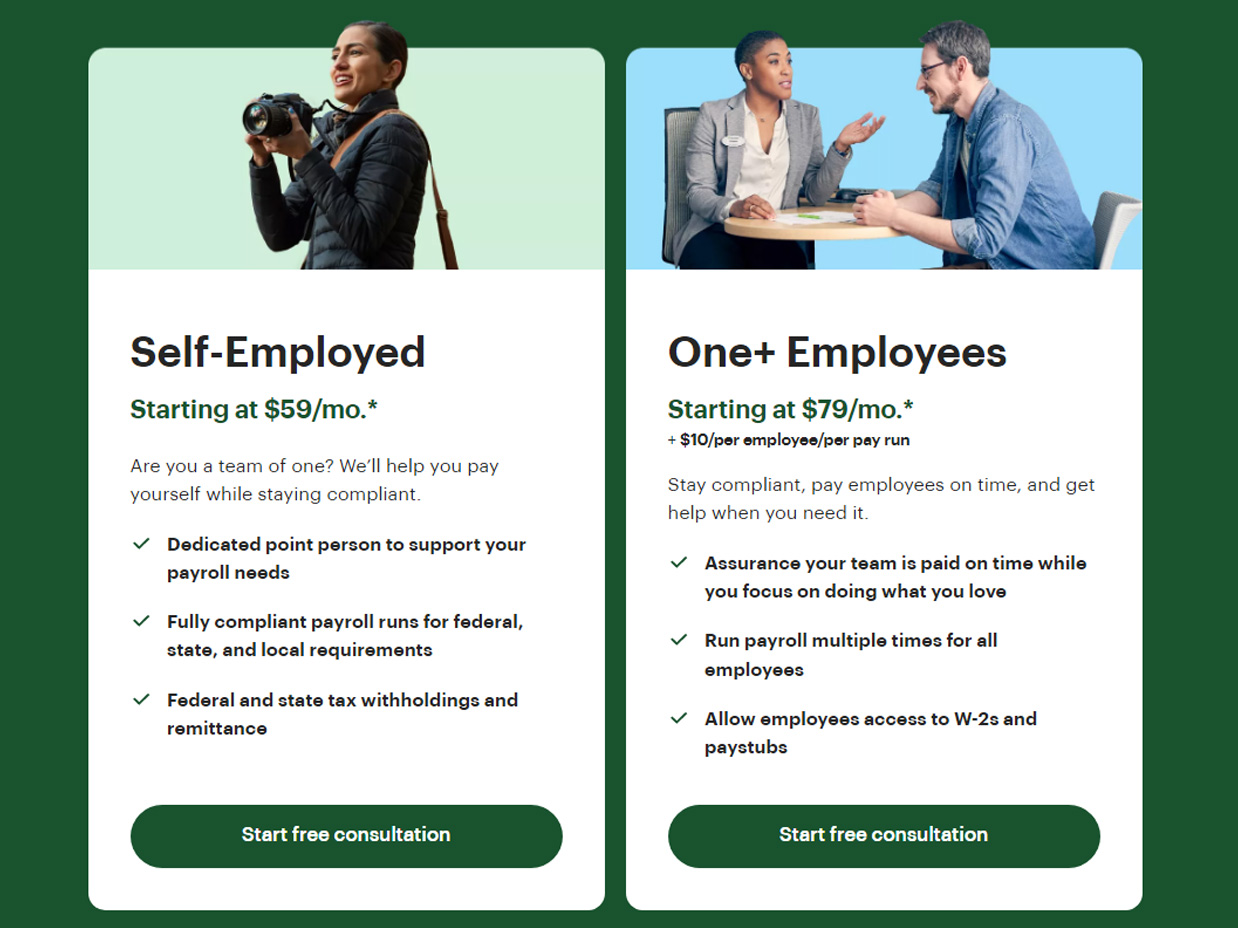

Block Advisors offer payroll service packages that include a dedicated account manager, set-up support on their platform, and fully compliant payroll runs for federal, state, and local requirements. Also, the package includes federal and state tax withholding and remittance, W-2 creation and distribution, quarterly payroll filing, and quarterly unemployment withholding. Besides, your employees will have access to W-2s and paystubs and you can run payroll multiple times for all employees.

Photo

Services

$50 Bookkeeping

We have small business bookkeeping services to help you save time and money — with full-service package rates up to half off a typical accountant’s rates. Go to disclaimer for more details^ Get started with a 30-minute meeting to be paired with your dedicated pro.

$59 Payroll

Our payroll professionals will be at your side all year long. We make it easy to hand off your payroll processing tasks and ensure payroll tax filings are a breeze.

$50 Tax

We help millions of business owners with self-employed and small business taxes each year. Whether you file with our tax pros in person or virtually or do your own with on-demand expert help, you’ll get the expertise you need.