Best Payroll Companies in 2023

Payroll is critical for every business. Employees are the bedrock of every enterprise, and companies must ensure they are compensated accurately. In the pre-digital era, businesses often calculated payroll by hand, a process prone to mistakes. Nowadays, most businesses use payroll software to make the process accurate and straightforward.

It can be challenging for businesses to choose the best payroll services because there are endless choices. We tested many platforms and selected the best ones, so you don’t have to worry about that. The result is this list of the 10 best payroll companies we have compiled. They include;

1. OnPay

OnPay is a cloud-based payroll processing service. It’s one of the best payroll services because of its relative affordability for businesses. It is a solid option for small business owners, with pricing starting from $6 per month per employee. You’ll also need to pay a $40 monthly base fee to use it.

OnPay fully automates your payroll processing tasks. It can calculate the compensation for each employee based on their unique data, such as the number of hours worked, retirement benefits, bonuses, sick leave, etc. It can also calculate and file payroll taxes according to the respective laws in 50 American states. The platform eliminates a lot of stress that you would otherwise have spent calculating these figures yourself.

OnPay offers an accuracy guarantee. If it makes any mistake with your tax filings and payments, it’ll work with the appropriate tax agency to resolve the error and leave you to focus on your business. It will also cover any potential fines levied because of the error.

We recommend OnPay as one of the best payroll outsourcing services for small businesses. However, if your business gets large (over 100 employees), you may find it limiting to work with.

2. ADP RUN

Automatic Data Processing (ADP) is a popular payroll software provider. ADP RUN is a payroll platform designed specifically for small businesses. We consider it one of the best payroll services because it reduces the time and effort that small businesses would have otherwise spent on payroll processing.

ADP RUN lets you access all your payroll records from a central dashboard. It gives you many options to pay employees, including checks, direct deposits, or a debit card. This platform automatically calculates and files payroll taxes for you, so you’re assured of being in good standing with tax authorities.

This platform automatically calculates benefits and retirement deductions depending on the state your business is based in. It can create and deliver W-2s and 1099s for your employees and even file them on your behalf.

ADP RUN comes with many extra features outside payroll processing. For example, you can use it to create unique onboarding experiences for your employees or offer perks like consumer discount programs. You can also use it to remit workers’ compensation insurance payments to your provider.

This platform doesn’t have standard pricing. You’ll have to contact the sales team for a custom quote. ADP notably offers its payroll software for free for the first three months, and you’ll start paying after that.

3. Paycor

Paycor is one of the world’s oldest human resource (HR) and payroll software companies. It combines human resource management and payroll processing into one platform.

Paycor provides an employee portal where you can manage employees and their payroll. Like most payroll service providers, it automatically calculates employee compensation based on unique data. It factors in local and state tax deductions, paid time off, number of hours worked, etc. You have different options to pay your employees, including checks and direct deposits.

Employees can access important information on their Paycor portal, such as their W-2 tax forms and benefits information. This platform has a mobile app, which makes it easier for employees to access their required information.

Paycor is ideal for companies having between 100 and 1,000 employees. Small business owners can still use it, but Paycor is more complex to use and understand than payroll tools designed for small businesses.

Paycor is one of the best payroll outsourcing companies because it offers broad features. It has no standard pricing, so you’ll have to contact the company’s sales team for a custom quote.

4. Gusto

Gusto is a relatively new payroll processing software company. It was founded in 2011 as ZenPayRoll in San Francisco, USA, before switching to its current name in 2015. We consider it one of the best payroll companies because of its advanced features and ease of use.

Gusto is a cloud-based tool that combines payroll processing and human resource management. Payroll takes just a few clicks with this platform, as it automatically calculates employee compensation based on unique data like paid time off, holidays, working hours, etc. It can automatically calculate and file payroll taxes for your business. It also helps you identify tax credits to save money.

Gusto works both for local payments and international contractor payments. It can automatically generate W-2 forms for local, full-time employees and 1099 forms for foreign contractors.

Gusto is a cloud-based tool with a modern, responsive interface. It’s noticeably easy to use and understand. Employees can download the Gusto Wallet mobile app to track and manage their compensation.

5. Paychex Flex

Paychex Flex is an online solution that offers payroll, benefits, and time management in one platform. Paychex is one of the best payroll outsourcing companies because it offers unique solutions for all sizes of businesses.

Paychex automatically calculates employee compensation for you based on the data you provide. It also automatically calculates and files payroll taxes depending on your jurisdiction.

This platform has a mobile app where employees can log in and retrieve their information, such as W-2 forms, to submit to tax authorities. They can also log in via the web interface if that’s what they prefer.

Paychex gives you different options for compensating employees, including direct deposits, paper checks, and debit cards. If you need help, you can contact a payroll specialist to provide their expertise. External help from payroll specialists is available 24/7.

Paychex allows you to monitor all your payroll data from a central dashboard. You can also use it to monitor employee benefits, e.g., group health insurance.

6. Intuit QuickBooks Payroll

Intuit QuickBooks is a top accounting software for small businesses. The company offers a payroll processing system for small businesses under the QuickBooks brand.

This payroll software is affordable, starting from $5 per month per employee. You’ll also have to pay a monthly base fee starting from $75. Intuit offers a 50% discount on the monthly base fee for the first three months.

If you already use Intuit QuickBooks for your accounting, you can contact the company to set up your payroll system. This system automatically calculates payroll and payroll taxes depending on your jurisdiction. You can use it to manage employee benefits such as health insurance and 401(k) plans. It has a module where you can shop for workers’ compensation insurance policies and pick the best plan.

You have different employee payment options with this tool, including checks and same-day direct deposits. It automatically generates tax forms for employees to submit to the appropriate authorities.

QuickBooks users can access 24/7 expert support if they encounter any issues. You can join the extensive list of companies in Singapore and abroad using QuickBooks for payroll.

7.TriNet

TriNet combines payroll, benefits, risk management, and compliance into one software platform. It’s one of the best payroll outsourcing companies because of its broad and advanced features.

This tool lets businesses streamline their payroll administration. It automatically calculates payroll for each employee at the end of a specified period and generates W-2 forms that they can submit as proof to tax authorities. Employees can monitor their compensation from the self-serve platform, including printing W-2 forms and tracking their paid time off.

TriNet will automatically calculate and withhold federal, state and local payroll taxes to ensure you’re in good standing with the Internal Revenue Service (IRS). It offers a time card tool for employees to clock in and out of work hours. It automatically calculates the compensation for each employee based on the data from this time card tool, e.g., overtime and paid time off.

TriNet lets you monitor payroll data and transactions from a central dashboard to ensure everything is done correctly. You can contact customer support if you notice any mistake.

Interested customers must contact TriNet’s sales team for a quote. You can negotiate a flat monthly fee for each employee.

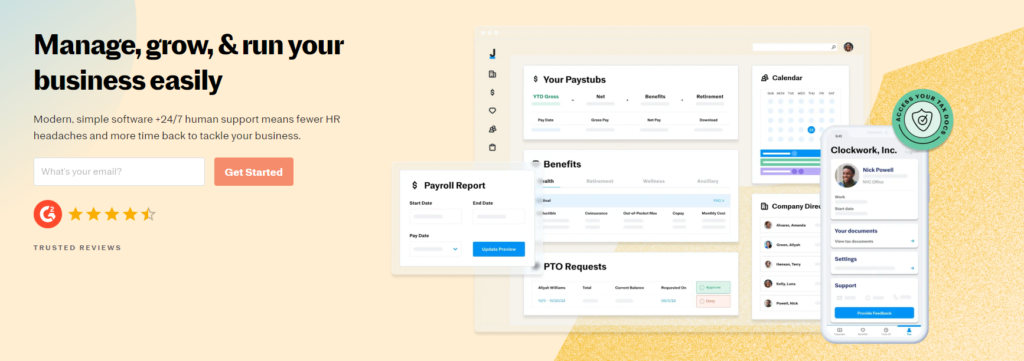

8. Justworks

Justworks is one of the best payroll companies that small and medium-sized businesses can adopt. It enables business owners to handle payroll, employee benefits, and HR management from one platform.

This platform is quite expensive. The Basic plan costs $59 per user per month for the first 49 employees and $49 monthly for the 50th employee and onwards. The Plus plan costs $99 monthly for the first 49 employees and $89 after that number. The Plus plan allows you to manage employee health insurance plans.

Justworks can automatically calculate payroll for your employees to ensure they are compensated adequately. It can automatically create W2 and 1099 forms for employees or contractors to submit to tax authorities.

Employees can access the Justworks mobile app to track their compensation and benefits. Businesses can also use this mobile app to onboard new employees and familiarize them with internal processes.

This platform offers 24/7 support from payroll specialists if you encounter any issues. You can contact them via phone, email, SMS, or Slack.

9. Deluxe

Deluxe is one of the best payroll services for businesses of all sizes. It offers an automated payroll system that ensures workers are compensated accurately.

Deluxe includes a time tracking tool, so it automatically calculates payroll based on the total work hours of every employee. It can also calculate, file, and withhold payroll taxes according to your jurisdiction.

Deluxe gives you several employee payment options, such as direct deposits. It can automatically issue W-2 and 1099 forms to your employees and contractors. It can also issue W-4 forms for federal income taxes.

Deluxe combines payroll and HR management in one platform. You can get detailed reports about all your payroll transactions from a central dashboard.

Pricing for this tool includes a $45 monthly base fee and $7 per employee per month for the basic version or $14 per employee per month for the enhanced version. The latter lets you create custom reporting fields and templates and digitizes every payroll document. Both plans include access to 24/7 expert support.

10. Wave Payroll

Wave is a cloud-based payroll system for small businesses. It makes it easy for American businesses to pay independent contractors and full-time employees. However, this platform is limited to 14 U.S. states; Arizona, California, Florida, Georgia, Illinois, Indiana, Minnesota, New York, North Carolina, Tennessee, Texas, Virginia, Washington, and Wisconsin. The company plans to launch in more states but has not offered a specific timeline.

Wave lets you pay employees via direct deposit quickly and reliably. It automatically calculates payroll based on each employee’s data and generates W-2 or 1099 forms to show to tax authorities. Employees can log in anytime to access their pay stubs and tax forms and manage their banking information.

Wave requires a $40 monthly fee plus $6 monthly per active employee or independent contractor. It is one of the best payroll services for small businesses because of its relative affordability.

Methodology

We considered several critical metrics to select the best payroll service for small companies. They include

Pricing

Pricing is the most important factor when choosing any software tool. We checked the pricing for each tool to ensure it delivers good value for what customers pay. Some payroll tools are affordable, while some are expensive.

Most payroll tools charge a base monthly or annual fee plus extra fees for each employee or contractor you’re processing payments for. Some platforms don’t list their pricing structure upfront, so you’ll have to contact their sales team for a custom quote.

Features

We considered the features each platform on our list offers to customers. Some payroll services offer basic features, while some offer advanced features. For instance, Gusto, TriNet, and Paycor combine human resource management and payroll processing in one platform, while Wave and OnPay focus primarily on payroll processing.

We ensured that every platform on this list delivers the necessary features for their users to process payroll seamlessly.

Third-Party Reviews

We considered third-party reviews from existing customers to select the finalists on our list. Platforms with noticeably negative reviews were ruled out, and platforms with positive reviews were considered more.

Third-party reviews don’t tell you everything because customers with a negative experience are likelier to leave reviews than those with positive experiences. However, any platform with considerably low ratings deserves scrutiny.

Expert Analysis

We considered opinions from independent payroll specialists about which platforms are the best to adopt. Specialists recommend different tools for different sizes of businesses, and we assessed their opinions to select the best platforms on this list.

What Are Payroll Services?

A payroll service provider is a company that aids with or assumes all payroll processing tasks for another business. This arrangement benefits business owners by ensuring their employees are compensated accurately and on time. It also frees up more time for the owners to focus on growing their business.

It can be difficult for businesses to choose the best payroll companies to use. Hence, we conducted extensive research and compiled the ten best payroll services available.

Payroll Processing Stages

- Get an employer identification number from your local tax agency. This number is required to track and process your payroll taxes.

- Collect banking details from your employees.

- Select a payroll schedule, e.g., weekly, bi-weekly, or monthly.

- Calculate gross pay for employees depending on the number of hours worked. Ensure you account for overtime (above 40 hours a week), which requires 1.5 times the hourly rate.

- Determine each employee’s deductions, such as 401(k) contributions, Social Security, Medicare, insurance, and federal, state, and local taxes.

- Calculate the net pay (after taxes) for your employees. Withhold the deductions and pay the total to your local tax agency at the end of each month or quarter.

- Send each employee their net pay via direct deposit, check, mobile wallets, debit cards, etc.

How To Process Payroll

- Gather time cards from your payroll software.

- Compute gross pay.

- Calculate the payroll taxes.

- Determine deductions for each employee.

- Calculate net pay for employees.

- Approve the payroll from your software.

- Pay employees via your payroll system and distribute pay stubs and tax forms.

How Does A Payroll Service Work?

Employees log in daily to clock in and out of their shifts on your payroll system. The system tracks employee hours automatically, and you can confirm its results at the end of a pay period.

After confirming the data, your payroll system automatically calculates each employee’s pay depending on the hours worked. It subtracts the required taxes, deductions, and withholdings and sends each employee’s net pay to their bank account.

Choosing Payroll Software

There are many payroll firms in Singapore and other countries. Choosing the best ones can seem difficult, but we’ve mentioned the most important factors to consider in this article’s “Methodology” section.

Your primary consideration should be pricing because you must choose a platform you can afford in the long term. Also, consider the features you want, e.g., if you need only payroll processing or payroll processing and HR management in a single platform. Lastly, consider third-party reviews and opinions from independent payroll specialists to choose the best platform.

FAQ

What Are Payroll Services?

They are platforms that help businesses to process payroll and ensure that employees are compensated accurately and timely. They calculate the required payment for each employee and the end of a given period and send them their money.

What Is the Best Payroll Company?

There’s no single best payroll outsourcing company. Instead, there are ideal platforms for different sizes and types of businesses. We compiled the list of the ten best payroll companies in this article.

What Are the Benefits Of Payroll Software?

It ensures that each employee gets their required pay at the right time. Without payroll software, you’ll have to manually calculate each employee’s pay and deductions, and you will likely make mistakes. Payroll software eliminates these mistakes and frees up time for business owners to focus on growing their companies.

Why are Payroll Services Important For Small Businesses?

The best payroll services ensure that small businesses pay their employees correctly and comply with federal, state, and local tax laws. Fortunately, we have compiled a list of the ten best payroll companies that small businesses can adopt.

How Long Does Payroll Take To Process?

Most payroll services complete payments within 1 to 5 days after authorization. Employees will likely receive their payments within five days following the end of a pay period.

Are there any free payroll software solutions?

Many payroll services offer free versions to businesses, albeit with limited features. Some payroll systems are entirely free, e.g., Payroll4Free, but they include advertisements to make money.