Alexander Bright

Description

Alexander Bright is an Australian accounting firm that provides professional business services for start-ups, small and medium businesses. They can help your company with accounting, bookkeeping, business taxation, business advisory, business set-up & compliance and many more.

Among the bookkeeping services provided by Alexander Bright we can mention cash flow management, credit control, payroll & superannuation, invoicing, business activity statements (BAS), installment activity statements (IAS), accounting software specialist, business set up & compliance, GST management, data entry and bank reconciliation.

Alexander Bright accounting and financial services include periodic performance overview & analysis, financial statements, business strategy alignment, CFO services, and company registration.

The company offers taxation services such as GST, BAS, managing tax risk, tax planning, structuring, capital gains tax (CGT), and income tax advisory.

Business advisory services offered by the company include budgeting & planning, cash flow forecasting, accounting automation, restructuring advice, financial modeling, pricing & costing, BI reporting, FinTech strategy, and finance recruitment.

Alexander Bright delivers business registration services such as business advice & compliance, new company registration & structural implementation, business plan formulation, accounting ledger setup & training, tax registration & optimisation, strategic advice on business development, and application of technology.

Also, they provide ASIC services such as changes to company details, application for voluntary deregistration of a company, notification of resolution to change company name, notification by a company to nominate or cease a registered agent or contact address, and copy of financial statements and reports. Additionally, the company experts can help with Form 410B & 410F application for reservation of a name, registered agent ceasing to act for a company or companies, and notification by officeholder of resignation or retirement. Besides, they aid with statements in relation to company solvency, request for correction, and notification of supplementary information.

Photo

Services

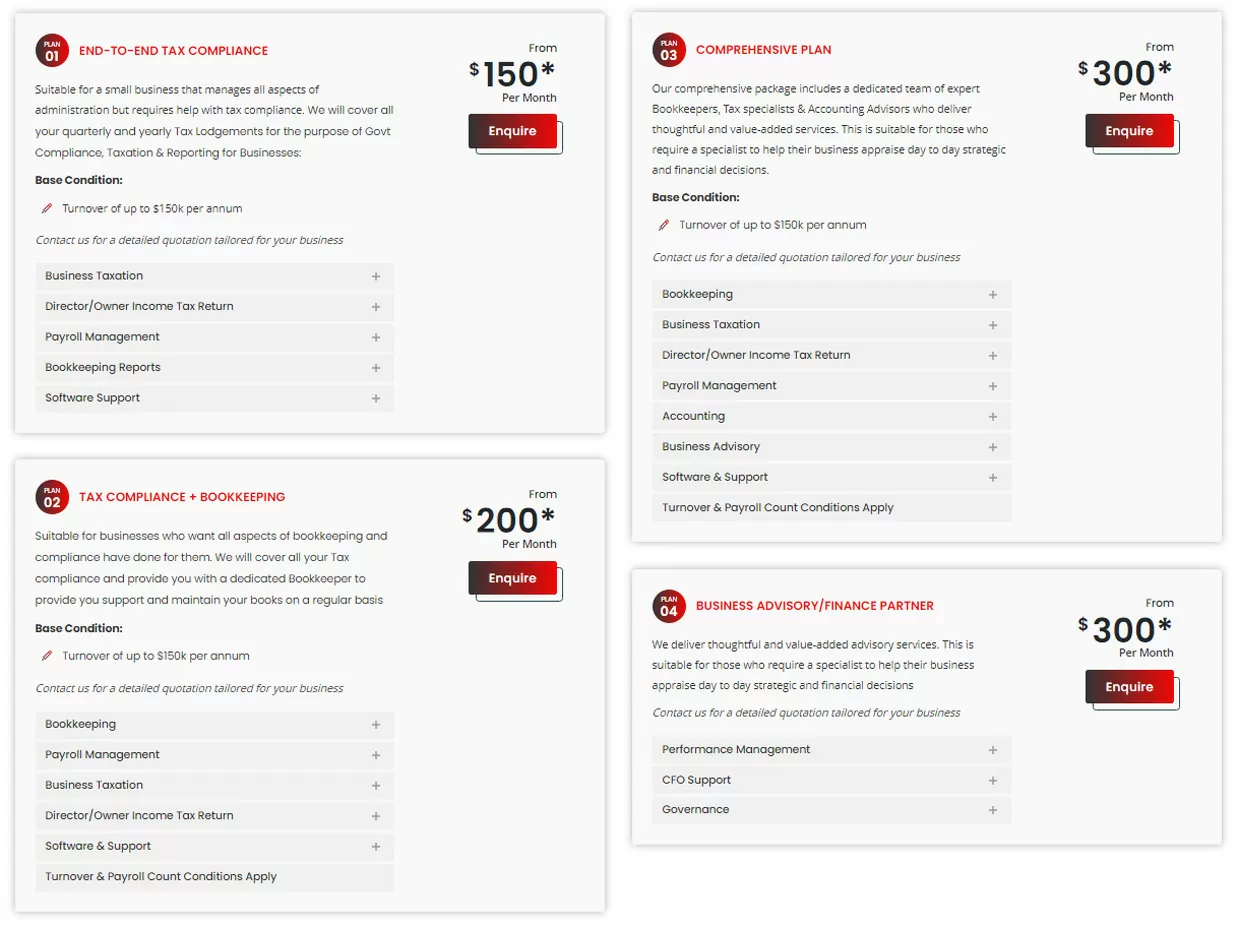

$150 Tax

If you require tailored business taxation services from trusted business accountants in Melbourne, book a consultation with Alexander Bright. You won’t need to worry about lodging your taxes on time or stress about complying with government taxation regulations, as our small business accountants in Melbourne can handle all this for you.

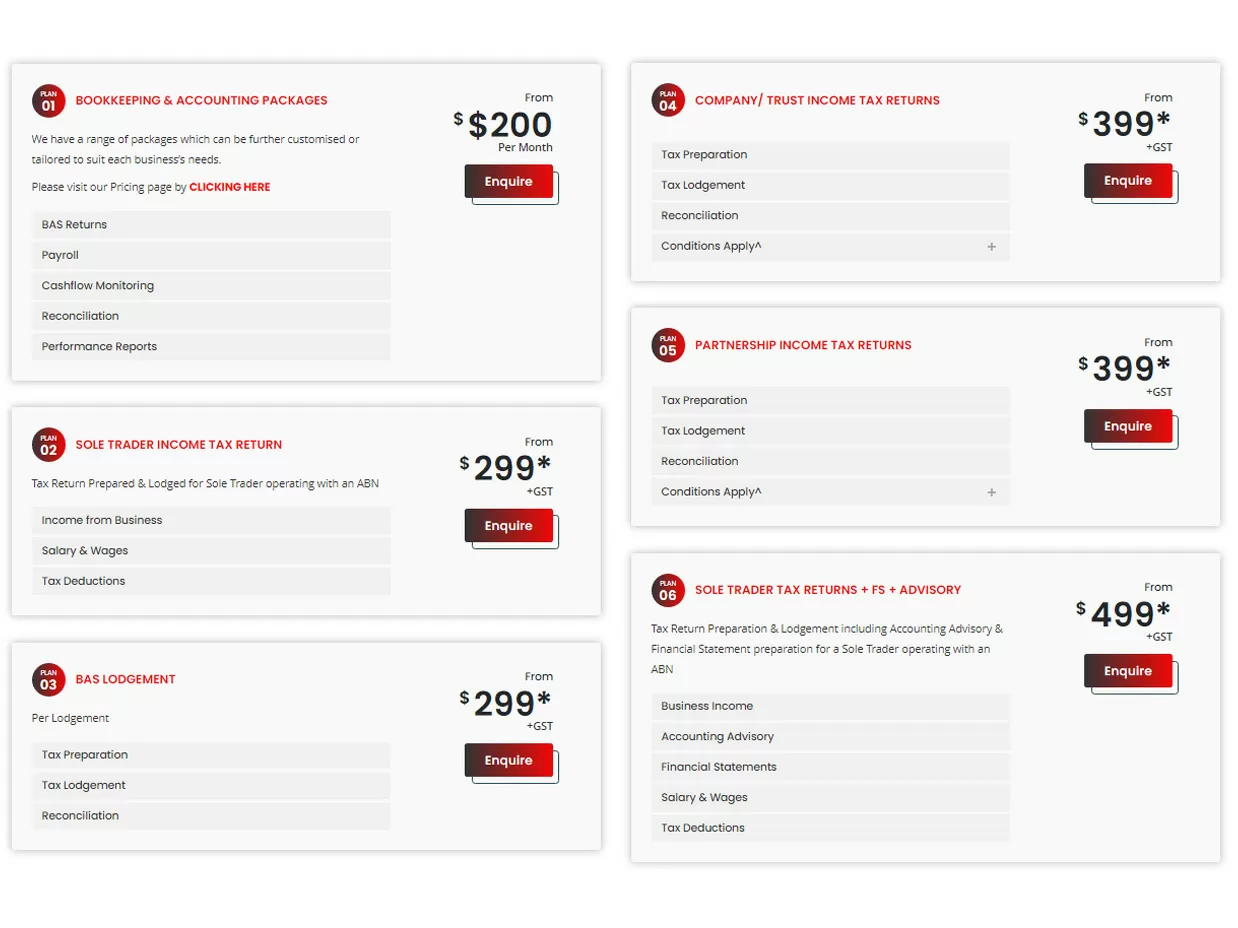

$200 Accounting

Accountants are meant to function as an asset to the business rather than an additional cost. Modern accountants are much more than just accountants because they provide value added benefits which should exceed the cost of their service over time.

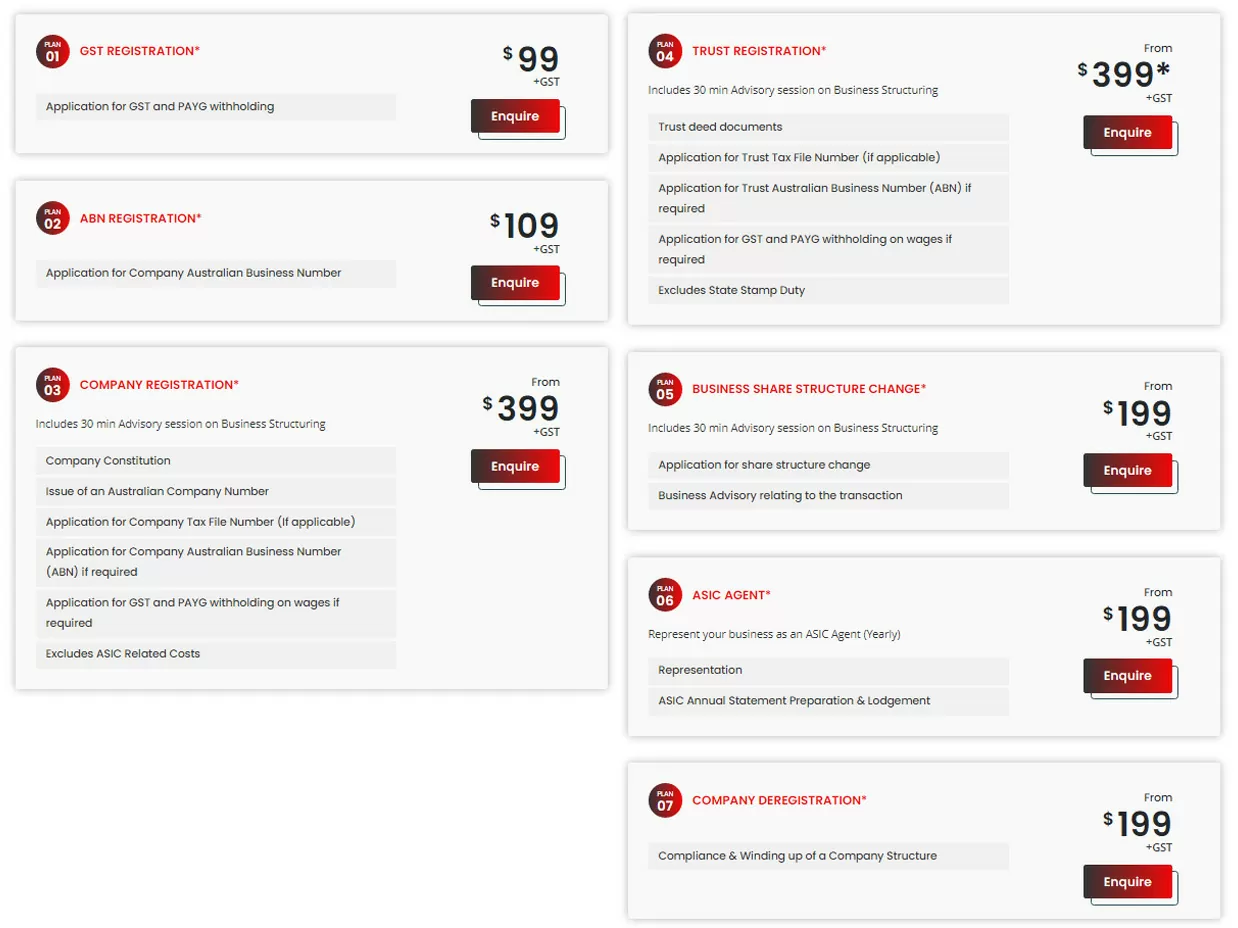

$399 Company Registration

Includes 30 min Advisory session on Business Structuring Company Constitution Issue of an Australian Company Number Application for Company Tax File Number (If applicable) Application for Company Australian Business Number (ABN) if required Application for GST and PAYG withholding on wages if required Excludes ASIC Related Costs

$99 GST REGISTRATION

Application for GST and PAYG withholding

$109 ABN REGISTRATION

Application for Company Australian Business Number

$399 TRUST REGISTRATION

Includes 30 min Advisory session on Business Structuring Trust deed documents Application for Trust Tax File Number (if applicable) Application for Trust Australian Business Number (ABN) if required Application for GST and PAYG withholding on wages if required Excludes State Stamp Duty

$199 BUSINESS SHARE STRUCTURE CHANGE

Includes 30 min Advisory session on Business Structuring Application for share structure change Business Advisory relating to the transaction

$199 ASIC AGENT

Alexander Bright has experienced ASIC registered agents in Melbourne who can provide support around your ASIC submissions and compliance requirements. We will complete and lodge documents to ASIC on behalf of your company.

$199 COMPANY DEREGISTRATION

Compliance & Winding up of a Company Structure

$299 SOLE TRADER INCOME TAX RETURN

Tax Preparation Tax Lodgement Reconciliation Conditions Apply

$499 SOLE TRADER TAX RETURNS + FS + ADVISORY

Tax Return Preparation & Lodgement including Accounting Advisory & Financial Statement preparation for a Sole Trader operating with an ABN

$300 Advisory

If you want to benefit from the expertise and knowledge of business advisors in Melbourne, arrange an appointment with the team at Alexander Bright to discuss your short and long term business goals. We are a B2B accounting and business advisory practice that is qualified and experienced to provide a full range of business advisory services for small business, medium sized business and start up business clients in Melbourne. We help businesses to grow and can assist you in adding that extra value your business deserves.

Bookkeeping

At Alexander Bright, we provide professional bookkeeping services to Melbourne based businesses across a range of different industries. We can take care of the time-consuming work of managing your books while you focus on other facets of your business. We take great pride in offering bookkeeping accounting services that help our clients with their BAS, GST, payroll and superannuation requirements.

Payroll

Alexander Bright is an experienced B2B payroll tax accountant who can handle your business’s payroll tax and GST accounting requirements. We aim to streamline your costs and ensure that your employees are being correctly paid in a timely manner.